Noticias de forex y análisis de mercado diario

Week Ahead: USDJPY set for Wednesday showdown

- Yen expected to be one of the most volatile in G10 space vs USD

- BoJ and Fed seen holding rates, but policy hints could spark volatility

- Over past year BoJ triggered moves of ↑ 1.4% & ↓ 1.5%

- Over past year Fed triggered moves of ↑ 0.7% & ↓ 1.2%

- Bloomberg FX model: USDJPY has 72% of trading within 146.26 – 151.17 over 1-week period

A flurry of major central bank meetings could present fresh trading opportunities.

The Japanese Yen is expected to be one of the most volatile G10 currencies versus the USD over the next one-week.

This could be based on the Bank of Japan and the Federal Reserve holding policy meetings on the same day!

Beyond central banks, top-tier economic data and global trade developments will be in focus:

Monday, 17th March

- CN50: China property prices, retail sales, industrial production

- CAD: Canada housing starts, existing home sales

- US500: US retail sales, Empire manufacturing

- OECD report – prospects for global economy

Tuesday, 18th March

- CAD: Canada CPI

- GER40: Germany ZEW survey expectations

- JP225: Japan tertiary index

- USDInd: US housing starts, industrial production

Wednesday, 19th March

- CHINAH: Tencent earnings

- EU50: Eurozone CPI

- ZAR: South Africa retail sales, CPI

- JPY: BoJ rate decision, industrial production, trade

- USDInd: Fed rate decision

Thursday, 20th March

- AUD: Australia unemployment

- CN50: China loan prime rates

- ZAR: SARB rate decision

- SEK: Riksbank rate decision

- CHF: SNB rate decision

- GBP: BoE rate decision, jobless claims, unemployment

- RUS2000: US Philadelphia Fed factory index, jobless claims

Friday, 21st March

- CAD: Canada retail sales

- EUR: Eurozone consumer confidence

- JPY: Japan CPI

- NZD: New Zealand trade

At the time of writing, the Yen depreciated across the board despite Japan's largest labour union - Rengo securing a 5.46% average gain, its largest pay hike since 1991. This could be a "sell the news" scenario with prices stabilizing down the line.

Nevertheless, the Yen is the 3rd best performing G10 currency versus the dollar year-to-date. These gains are on the back of global trade fears and growing bets around the BoJ hiking rates sooner rather than later.

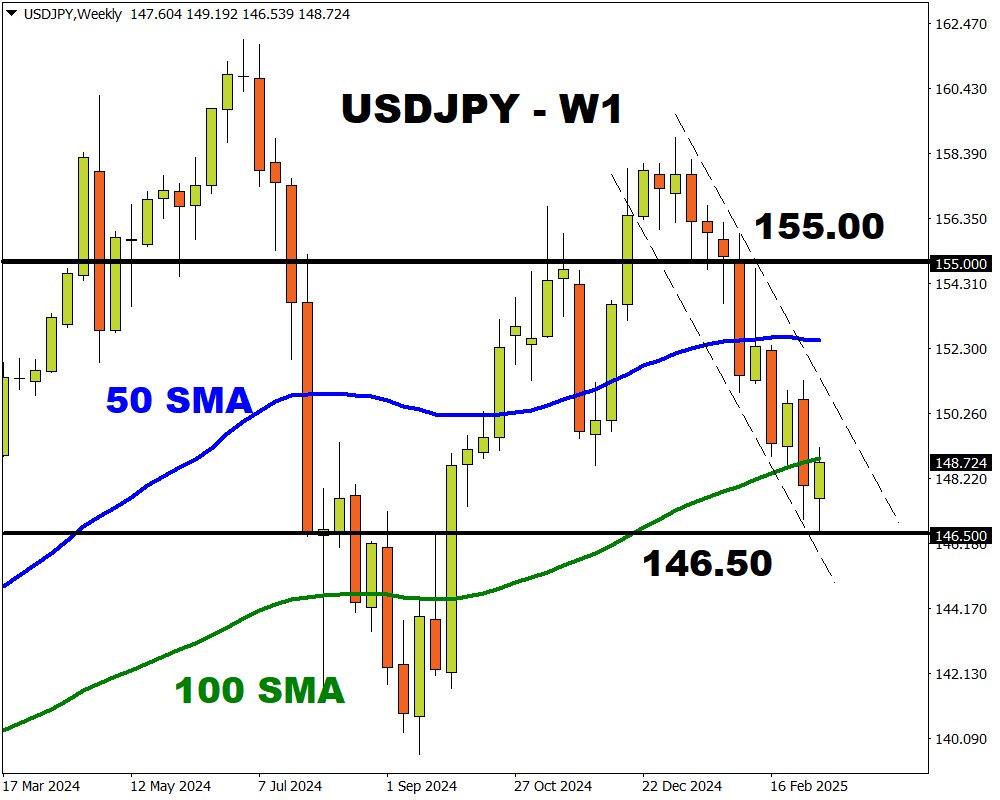

Looking at the weekly charts, the USDJPY is respecting a bearish channel – but support can be seen at 146.50.

With all the above said, here is why the USDJPY is set for a big week:

1 - Trump’s trade war

President Donald Trump’s aggressive stance on trade has roiled markets, sending investors rushing toward safe-haven assets.

Trump recently threatened a 200% tariff on European alcohol after the EU imposed tariffs on US-produced whiskey.

- Escalating trade tensions could boost the Japanese Yen – dragging the USDJPY lower.

- Signs of easing trade tensions may lift the market mood – pushing the USDJPY higher as the Yen weakens.

2- BoJ rate decision

Markets widely expect the BoJ to leave interest rates unchanged at its meeting on Wednesday 19th March.

But if the BoJ hints at a potential hike as soon as May or in the first half of 2025 in the face of higher wages, this could move the Yen.

To be clear, traders are currently pricing in a 16% probability of a 25-basis point hike by May with this jumping to 48% by June.

Over the past 12 months, the BoJ decision has triggered upside moves as much as 1.4% or declines of 1.5% in a 6-hour window post-release.

Note: Beyond the BoJ decision, Japan’s latest inflation print later in the week could influence BoJ hike bets – moving the Yen as a result.

- The USDJPY could tumble if the BoJ hints that rates will be hiked in May or June.

- Should the BoJ strike a dovish tone, this could push the USDJPY higher as the Yen weakens.

3 - Fed rate decision

The Federal Reserve is seen leaving interest rates unchanged at its meeting on Wednesday, 19th March.

So, all eyes will be on Fed Chair Jerome Powell’s press conference for clues on future policy moves. Last Friday, Powell stated that the US economy was in a good place despite the elevated levels of uncertainty. However, investors remain fearful of Trump’s trade war hitting the US economy.

Traders are currently pricing in a 35% probability of a 25-basis point cut by May with a move fully priced in by June.

Over the past 12 months, the Fed decision has triggered upside moves as much as 0.7% or declines of 1.2% in a 6-hour window post-release.

- If Powell strikes a cautious tone towards rate hikes, the USDJPY may slip.

- Should Powell signal higher rates down the road, this could push the USDJPY higher.

4 - Technical forces

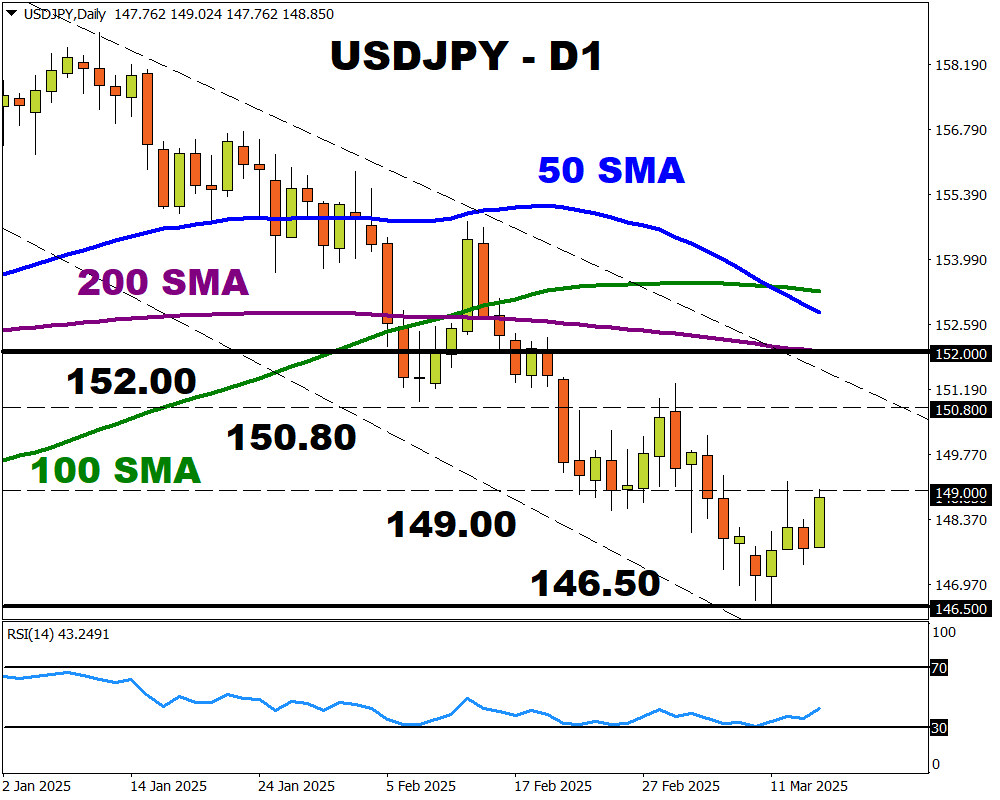

The USDJPY has shed over 1% month-to-date with prices trading below the 50, 100 and 200-day SMA.

- A breakout and daily close above 149.00 may signal a move toward 150.80 and 151.17 – the upper limit of the Bloomberg FX model.

- Sustained weakness below 149.00 could trigger a selloff back toward 146.50 and 146.26 – the lower limit of the Bloomberg FX model.

Bloomberg’s FX model forecasts a 73% chance that USDJPY will trade within the 146.26 – 151.17 range, using current levels as a base, over the next one-week period.

¿Está listo para operar con dinero real?

Abra una cuentaElija su cuenta

Comience a operar con un bróker líder que le ofrece más.