Daily Market Analysis and Forex News

Week Ahead: US500 braces for massive week of risk events

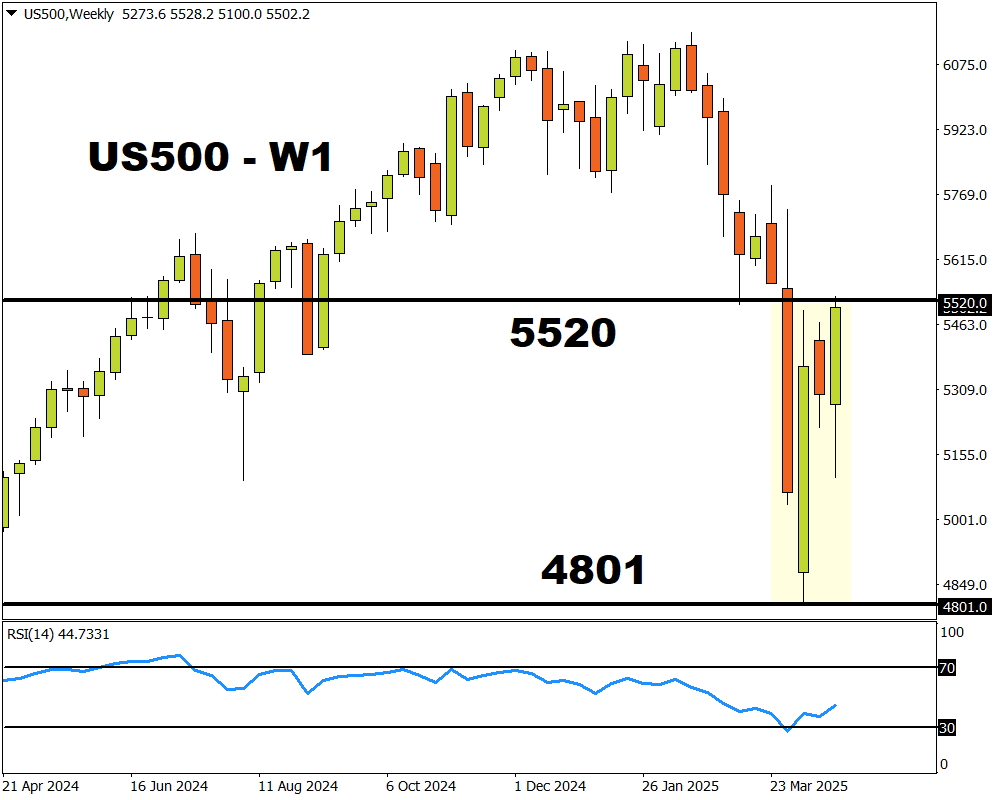

US500 rebounds 15% from 2025 low

Meta, Microsoft, Amazon & Apple make almost 20% of US500 weight

US GDP, PCE & NFP report could impact Fed cut bets

NFP sparked moves of ↑ 1.2% & ↓ 3.2% over past year

Technical levels: 50-day SMA, 5500 & 5300

US-China trade developments, major economic data and big tech earnings will dominate the week ahead:

Sunday, 27th April

- CN50: China industrial profits

Monday, 28th April

- SG20: Singapore unemployment

- CAD: Canadians head to the polls in a snap vote

Tuesday, 29th April

- EUR: Eurozone consumer confidence

- SPN35: Spain GDP, CPI

- UK100: HSBC earnings

- RUS2000: Conference Board consumer confidence

Wednesday, 30th April

- AUD: Australia CPI

- CN50: China official PMIs, Caixin manufacturing PMI

- EUR: Eurozone GDP

- GER40: Germany CPI, GDP, unemployment

- JP225: Japan industrial production, retail sales

- TWN: Taiwan GDP

- US500: US GDP, PCE price index, ADP employment, Meta, Microsoft earnings

Thursday, 1st May

- May Day - European markets closed except UK

- AUD: Australia trade

- JPY: BoJ rate decision

- UK100: UK S&P Global Manufacturing PMI

- US500: US ISM manufacturing, initial jobless claims, Amazon, Apple earnings

Friday, 2nd May

- AUD: Australia retail sales

- EUR: Eurozone CPI, unemployment, Germany HCOB Manufacturing PMI

- JP225: Japan unemployment

- US500: US April jobs report

The spotlight shines on FXTM’s US500 which has rebounded 15% from its 2025 low.

Note: FXTM's US500 tracks the underlying S&P 500 index

Recently, US equities have been empowered by bets around the Fed cutting interest rates sooner than expected to prevent a recession. However, uncertainty around trade talks may impact upside gains.

Still, the US500 is over 4% this week, lingering around key resistance at 5500.

Here are 4 factors that could trigger significant price swings:

1) US-China trade saga

China denied having any trade talks with the United States despite Trump’s claims of progress earlier in the week. However, Trump has pushed back against China’s denial, stating that negotiations were happening.

On a brighter note, there are reports of China’s government weighing the suspension of its 125% tariffs on some US imports.

- If this eases tensions and paves the path to actual negotiations, the US500 may jump as risk appetite improves.

- Any signs of escalating tensions or growing uncertainty around trade developments may weigh on the US500.

2) Big tech earnings

Four of the so-called “Magnificent” 7 tech giants with a combined market cap of over $9 trillion are set to publish their results in the week ahead.

Quarterly results from Meta, Microsoft, Amazon and Apple could provide fresh insight into how the industry fared last quarter in the face of Trump’s tariffs. Google-parent Alphabet has already set the bar high by reporting solid earnings.

Considering that the combined weight of Meta, Microsoft, Amazon and Apple makes up roughly 19% of the US500, the incoming earnings could spark significant price swings.

- A solid set of results and optimistic forward guidance from tech titans may propel the US500 higher.

- Should results disappoint and concerns expressed about the earnings outlook, the US500 could sink.

3) US data dump: Q1 GDP, PCE inflation, ISM & NFP

Fed officials have hinted at a possible rate cut if tariffs start weighing on the US jobs market and economic growth.

This puts extra attention on the US data dump in the week ahead, featuring Q1 GDP, Fed’s preferred inflation gauge and the latest NFP jobs report.

- Wednesday 30th April – Q1 GDP, US PCE price index

Note: Over the past 12 months, the US GDP report has triggered upside moves on the US500 of as much as 0.7% or declines of 1.7% in a 6-hour window post-release.

- Thursday 1st April – US ISM Manufacturing

Note: Over the past 12 months, the US ISM Manufacturing report has triggered upside moves on the US500 of as much as 1.0% or declines of 2.0% in a 6-hour window post-release.

- Friday 2nd April – US April NFP report

Note: Over the past 12 months, the US NFP report has triggered upside moves on the US500 of as much as 1.2% or declines of 3.2% in a 6-hour window post-release.

Traders are currently pricing three Fed rate cuts in 2025 with the odds of a fourth cut by December at 35%. Any major shifts to these bets may influence the US500.

- A set of figures that support the case around the Fed cutting interest rates sooner than expected may push the US500 higher. But gains may be capped by recession fears.

- While stronger-than-expected data may cool Fed cut bets, the US500 may rise if sentiment improves over the US economic outlook.

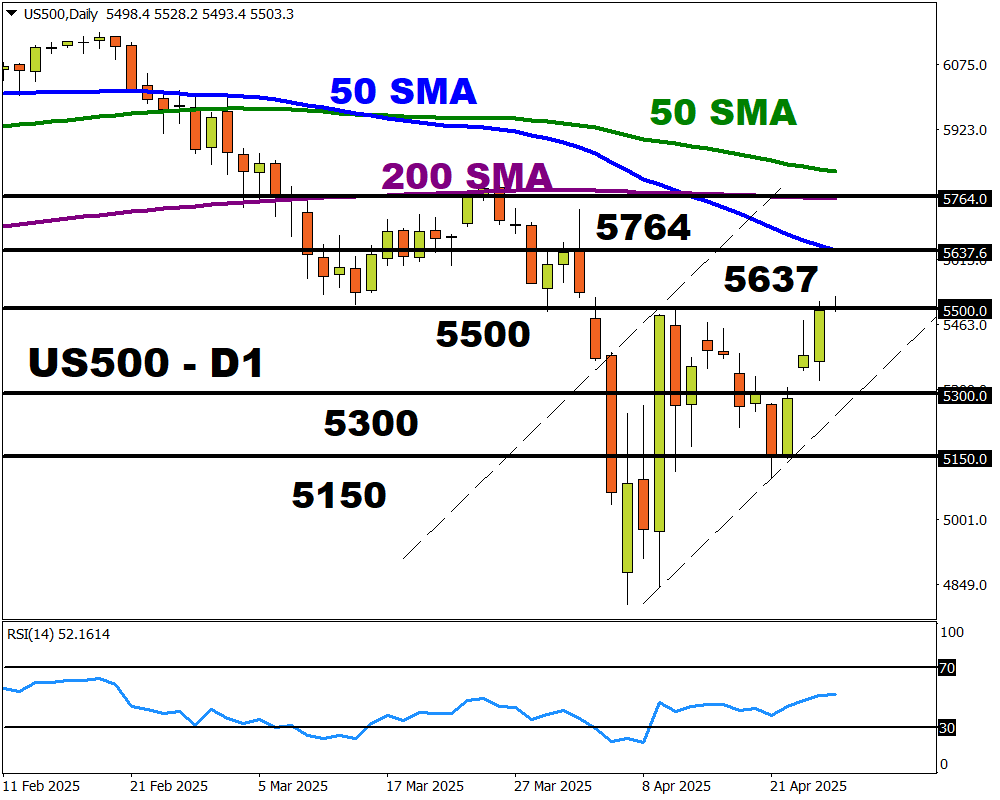

4) Technical forces

The US500 is testing key resistance at 5500, but prices remain below the 50, 100 and 200-day SMA.

- A solid breakout and daily close above 5500 may inspire a move toward the 50-day SMA at 5637 and the 200-day SMA at 5764.

- Sustained weakness below 5500, may drag prices back toward 5300 and 5150.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.