Daily Market Analysis and Forex News

Week Ahead: GBPUSD set for end March mayhem?

GBPUSD ↑ almost 3% MTD

Wednesday = UK Spring Statement + UK CPI

Over past year UK CPI triggered moves of ↑ 0.5% & ↓ 0.3%

Across the Atlantic = Fed speeches + US PCE report

Bloomberg FX model: GBPUSD has 75% of trading within 1.2799 – 1.3081 over 1-week period

The week ahead is stacked with high-impact data, political events and speeches by numerous policymakers:

Sunday, 23rd March

China Development Forum 2025 in Beijing

Monday, 24th March

CHINAH: BYD earnings

TWN: Taiwan jobless rate

GER40: Germany HCOB Manufacturing & Services PMI

GBP: UK S&P Global Manufacturing & Services PMI, BoE Governor Bailey speech

US500: US S&P Global Manufacturing & Services PMI, Atlanta Fed Bostic speech

Tuesday, 25th March

Boao Forum for Asia – dubbed “China’s Davos”

GER40: Germany IFO business climate

MXN: Mexico retail sales, international reserves

TWN: Taiwan industrial production

RUS2000: US new home sales, Conference Board consumer confidence, New York Fed Williams speech

Wednesday, 26th March

AUD: Australia CPI

CAD: BoC meeting minutes

SG20: Singapore industrial production

GBP: UK CPI, UK Chancellor Rachel Reeves delivers “spring statement”

US500: CBO releases estimate of when US debt will be reached, St. Louis Fed Musalem speech

World Economic Forum symposium in Hong Kong

Thursday, 27th March

MXN: Mexico trade, rate decision

USDInd: US revised 4Q GDP, initial jobless claims, Richmond Fed Barkin speech

Friday, 28th March

EUR: Eurozone consumer confidence

GER40: Germany unemployment

JPY: Japan Tokyo CPI

GBP: UK Q4 GDP (final), retail sales

USDInd: US February PCE report, University of Michigan consumer sentiment, Atlanta Fed Bostic speech

GBPUSD could be set for a week of mayhem due to economic and political forces!

The major currency pair has struggled to push beyond 1.30 despite the BoE’s slightly hawkish vote split on rates.

Nevertheless, prices have jumped as much as 7.5% from the mid-January low with month-to-date gains up almost 3%.

Here are 4 things to keep an eye on:

1 - UK Spring Statement

On Wednesday 26th March, Chancellor of the Exchequer Rachel Reeves will present the Spring Statement to Parliament.

Investors will pay close details on key updates concerning the country’s finances, and government plans for tax and public spending. The UK’s growth forecast is set for a major downgrade with Reeves expected to announce huge spending cuts over tax rises. This event will certainly shape sentiment toward the UK economy and British Pound.

- Sterling is likely to sink if the Spring budget dents optimism over the UK economy and fuels bets around lower UK interest rates.

- Should the Spring budget soothe investor fears over the UK’s outlook, the pound may rise.

2 - BoE Bailey Speech + UK February CPI

Just days after the BoE voted to leave rates unchanged, BoE governor Andrew Bailey is scheduled to speak on the UK economy on Monday 24th March. Any fresh insight offered on future policy moves may move the Pound.

But the real market mover for Sterling could be the latest UK inflation figures published on Wednesday 26th March. Signs of cooling price pressures may impact BoE cut bets.

Annual inflation is expected to cool 2.9% from 3.0%, while the monthly print is seen rising 0.5% from -0.1%.

Over the past 12 months, the UK CPI has triggered upside moves of as much as 0.5% or declines of 0.3% in a 6-hour window post-release.

Note: Beyond the CPI report, the PMI report on Monday and retail sales figures on Friday may provide more insight into the health of the UK economy. Should they disappoint, this could weaken the Pound. The same is true vice-versa.

3- US February PCE report + Fed speeches

Across the Atlantic, a string of speeches by Federal Reserve officials could provide some fresh insight into the Fed’s thinking on rates.

But the Fed’s preferred inflation gauge – the Core Personal Consumption Expenditure on Friday 28th March may sway rate cut bets.

In the March policy meeting, Powell sought to calm fears over Trump’s tariffs suggesting any rise in prices would be “transitory”. So, this may place extra focus on US inflation reports moving forward, leading to increased market sensitivity.

The PCE core deflator is expected to remain unchanged at 0.3% MoM but rise 2.7% from 2.6% annually. Ultimately signs of sticky price pressures may push back Fed cut bets.

Over the past 12 months, the US PCE report has triggered upside moves as much as 0.6% or declines of 0.8% in a 6-hour window post-release.

Note: It’s not only the PCE data that move the USD, PMIs, consumer confidence data and initial jobless figures may result in price swings.

4- Technical forces

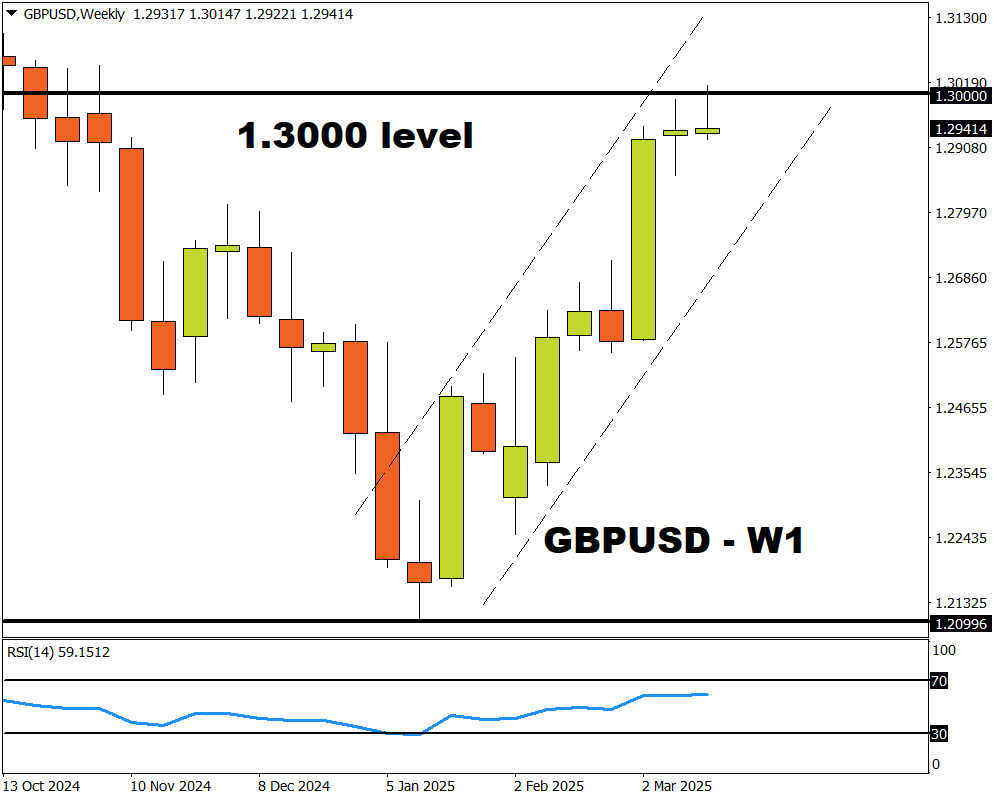

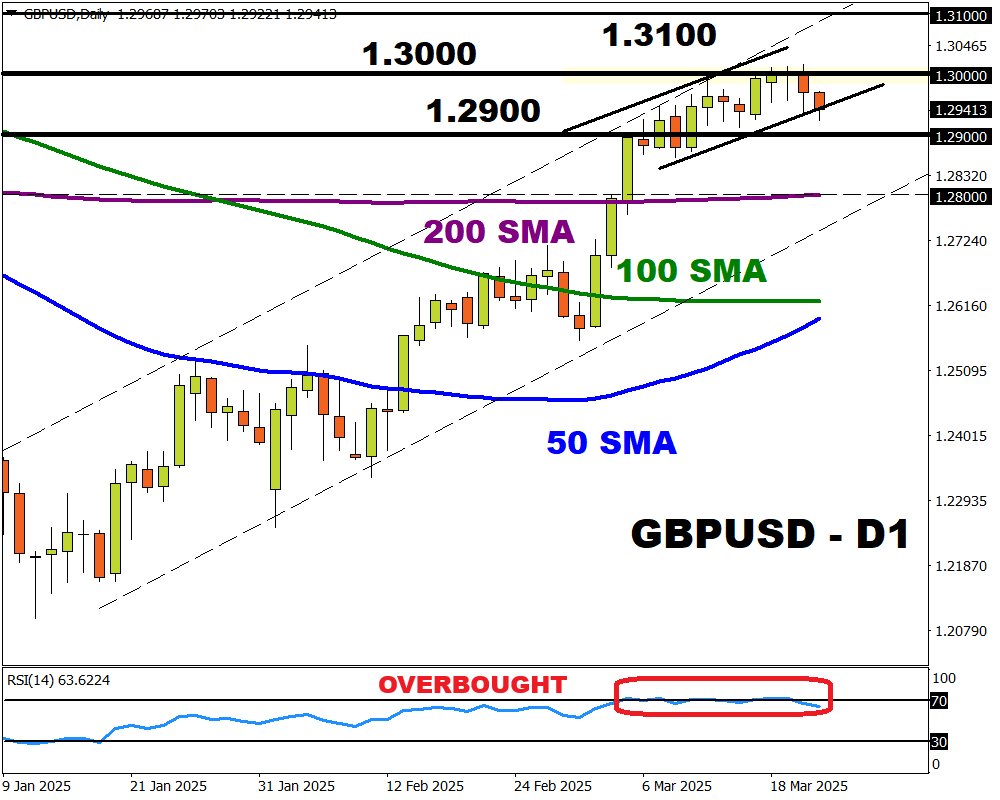

The GBPUSD is back within a range on the daily charts with support at 1.2900 and resistance at 1.3000. Despite respecting a bullish channel, the RSI has been overbought since early March.

- A breakout above 1.3000 may open a path toward 1.3100.

- A breakdown below 1.2900 could trigger a decline toward 1.2870 and the 200-day SMA at 1.2800.

Bloomberg’s FX model forecasts a 75% chance that GBPUSD will trade within the 1.2799 – 1.3081 range, using current levels as a base, over the next one-week period.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.