Daily Market Analysis and Forex News

Week Ahead: Dollar threatened by Trump’s tariff chaos

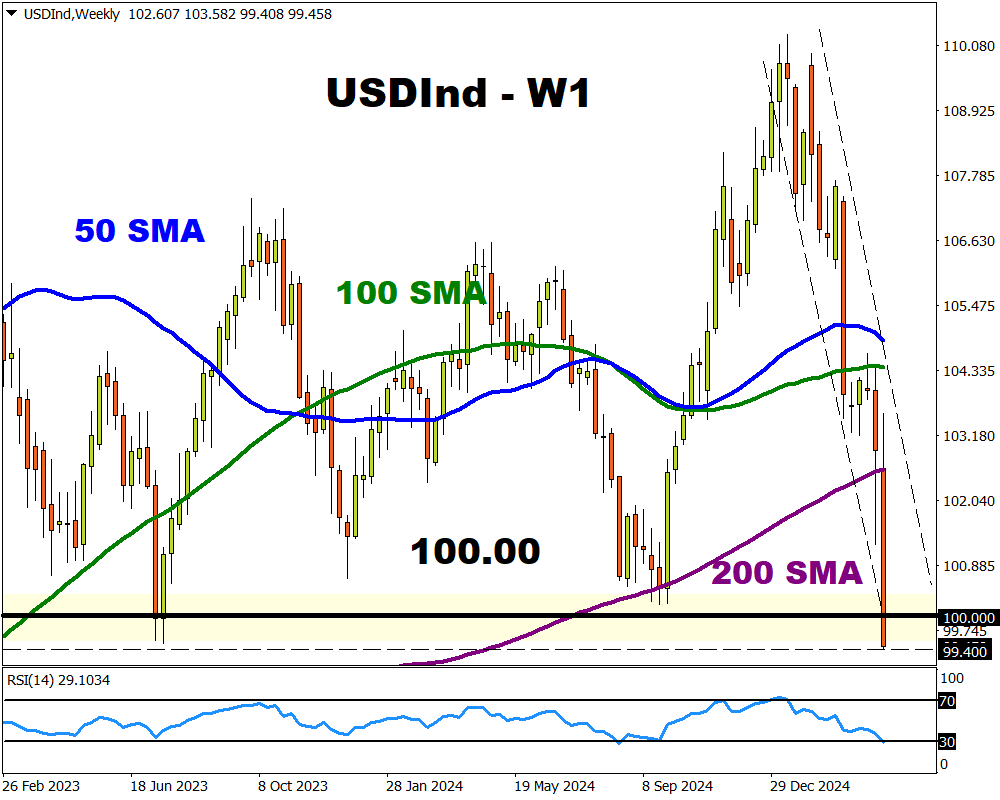

USDInd ↓ 4.5% MTD

Trump’s tariff chaos drags USDInd to lowest level since April 2022

US data + ECB meeting + BoC meeting = heightened volatility?

ECB meeting sparked moves of ↑ 0.3% & ↓ 0.3% over past year

Technical levels – 100.00, 99.30 & 98.00

The dollar is being slammed by US recession fears as confusion reigns over Trump’s tariff play.

It has weakened against most G10 currencies in April with FXTM’s USDInd sinking levels not seen since April 2022.

Washington recently clarified that the new tariff rate on most Chinese imports is in fact 145%, not 125% initially reported.

Given how the two largest economies in the world are locked in a tit-for-tat battle of soaring tariffs, this remains a threat to the global economy.

Much focus will be on the US-China trade war, central bank decisions, top-tier data and major US bank earnings in the week ahead:

Monday, 14th April

- CN50: China trade

- JP225: Japan industrial production

- SG20: Singapore GDP, central bank decision

- US30: Goldman Sachs earnings, Fed speech

Tuesday, 15th April

- CAD: Canada CPI

- EUR: Eurozone ZEW survey, industrial production

- GER40: Germany ZEW survey

- NZD: New Zealand food prices

- UK100: UK jobless claims, unemployment

- US500: US Empire manufacturing, Citigroup, Bank of America earnings

Wednesday, 16th April

- CN50: China GDP, property prices, retail sales, industrial production

- CAD: BoC rate decision

- EU50: Eurozone CPI, ASML earnings

- GBP: UK CPI

- USDInd: US retail sales, industrial production, Fed Chair Powell speech

- WTO releases global trade forecasts

Thursday, 17th April

- AUD: Australia unemployment

- EUR: ECB rate decision

- NZD: New Zealand CPI

- TWN: Taiwan Semiconductor Manufacturing Company (TSMC) earnings

- USDInd: Jobless claims, Philadelphia Fed manufacturing index

Friday, 18th April

- US markets closed: Good Friday holiday

- JP225: Japan CPI

- USDInd: San Francisco Fed President Mary Daly speech

Investor confidence in the US economy and government continues to dwindle amid the constant back and forth on tariffs. This has weakened the dollar and raised bets around lower US interest rates in the face of slowing growth.

Looking at the charts, the USDInd is trading below the psychological 100.00 for the first time since July 2023.

FXTM’s USDInd measures how the dollar performs against a basket of six different G10 currencies, including the Euro, British Pound, Japanese Yen, and Canadian dollar.

Beyond the ongoing US-China trade war, here are 4 more reasons why the USDInd could see heightened volatility:

1) US data dump + Powell speech

The incoming data could offer fresh insight into the health of the largest economy in the world. A speech by Fed Chair Jerome Powell and other policymakers could provide clues into the Fed’s next policy move.

On Tuesday, the US empire manufacturing will be published. Wednesday sees the latest US retail sales, industrial production and speech by Fed Chair Powell. On Thursday, the latest jobless claims and Philadelphia Fed manufacturing index will be in focus.

- The USDInd could appreciate if overall data prints better than expected and Powell along with other Fed speakers strike a hawkish note.

- If economic data disappoints and Fed officials adopt a dovish stance, the USDInd could sink as Fed cut bets jump.

2) ECB rate decision

The ECB is widely expected to cut interest rates by 25 basis points at its meeting on Thursday, April 17th.

Growing concerns over the impacts of Trump’s tariffs on the global economy may force the central bank to signal more rate cuts down the road.

Note: The Euro accounts for almost 60% of the USDInd weighting. A weaker euro tends to push the index higher and vice versa.

As of writing, traders have fully three ECB rate cuts in 2025 with the odds of a fourth one by December at 25%.

- The USDInd could jump if the ECB cuts rates and signals more down the road.

- If the ECB sounds less dovish than expected on future rate cuts, this could drag the USDInd lower as the Euro appreciates.

Note: Over the past 12 months, the ECB rate decision has sparked upside moves as much as 0.3% or declines of 0.3% in the 6 hours post-release.

3) BoC rate decision

Traders are currently pricing in a 30% probability that the Bank of Canada will cut rates in April.

But this could easily be influenced by the March CPI report published a day before the BoC rate decision. Back in February, the annual inflation rate in Canada jumped to 2.6% from 1.9% in the previous month.

A hotter than expected inflation report may force the BoC to stand pat on cutting interest rates while a signs of cooling price pressures may provide the breathing room for a cut.

Note: The Canadian Dollar accounts for roughly 9% of the USDInd weighting. A weaker CAD may push the index higher and vice versa.

- The USDInd may edge higher if the BoC cuts rates and signals more cuts in 2025.

- If the BoC decides to leave rates unchanged, this may weigh on the USDInd as the CAD appreciates.

Note: Over the past 12 months, the BoC rate decision has sparked upside moves as much as 0.2% or declines of 0.3% in the 6 hours post-release.

4) Technical forces

The USDInd is under intense pressure on the daily charts with prices trading below the 50, 100 and 200-day SMA. However, the Relative Strength Index (RSI) is trading near oversold levels.

- A daily close below 100.00 may encourage a decline toward 99.30 and 98.00

- Should 100.00 prove to be reliable support, this may trigger a rebound back toward 101.00 and 101.80.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.