Daily Market Analysis and Forex News

Market round-up: Tariff hopes, ECB cuts, Gold shines

Markets eye US-Japan trade talks

ECB cuts rates for the seventh consecutive time

Gold touches fresh all-time high, ↑ 27% YTD

Oil extends rebound on supply risk

Caution was a key theme this week as investors monitored global trade developments.

There was some focus on country-specific negotiations which lifted sentiment. However, the ongoing US-China drama remained front and centre with China being open to talks if the US showed respect.

This development along with optimism around US-Japan talks kept risk assets buoyed.

Euro slips as ECB cut rates

In a widely expected move, the European Central Bank lowered interest rates by 25 basis points on Thursday.

This was the seventh consecutive cut since last June as global trade tensions fuelled fears over the region’s economic outlook. Officials also dropped the word “restrictive” from their statement, signalling further rate cuts down the road.

Traders are currently pricing in two more ECB cuts this year with the probability of a third cut by December at 60%.

FXTM’s EU50 offered a muted response to the decision while the EURUSD edged slightly lower before clawing back losses.

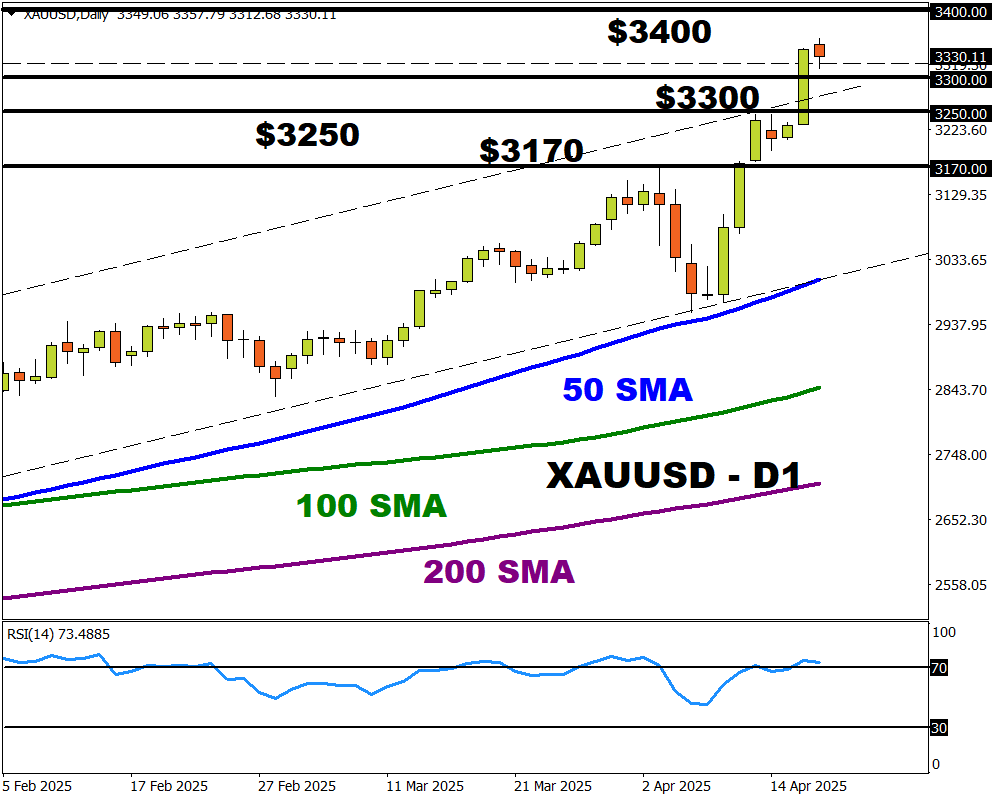

Gold touches all-time high…

It’s been another week of record highs for gold amid dollar weakness and global recession fears.

The precious metal touched a fresh all-time high at $3357.78 on Thursday before giving back some gains. Gold has gained 6.5% this month, pushing its 2025 gains to almost 27%.

Given how technical indicators are signalling that prices are heavily overbought, a correction could be around the corner – especially if risk sentiment improves.

- Looking at the charts, weakness below $3320 may open a path back toward $3300 and $3250.

- Should $3300 prove reliable support, this could trigger a move toward $3350 and $3400.

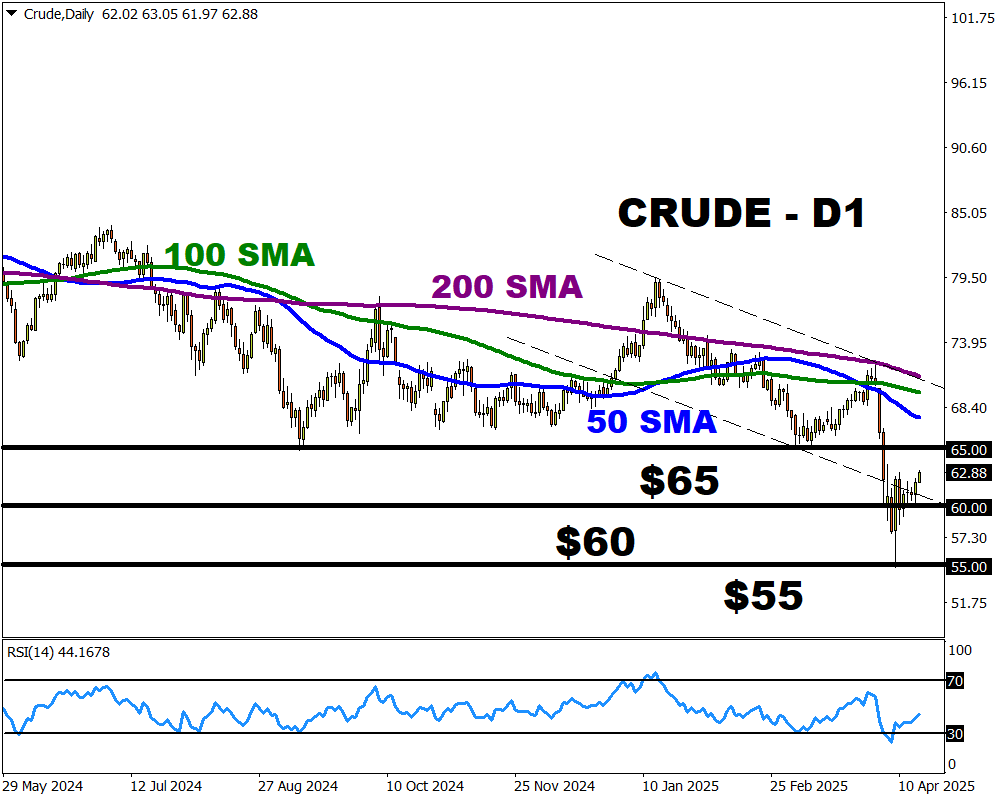

Oil extends gains on supply risk

Oil benchmarks jumped over 1% on Thursday after Trump vowed to reduce Iran’s energy exports to zero. Growing optimism around US-China trade talks also eased growth fears, feeding the rally.

Although oil may edge higher in the short term, the medium to longer-term outlook still favour bears. Fears around the global economy may hit the demand outlook while OPEC+ decision to accelerate production increases has sparked fears of a looming surplus.

In addition, OPEC recently cut its 2025 global oil demand growth forecast for the first time since December, due to the impacts of trade tariffs.

WTI crude remains under pressure on the daily charts despite the recent rebound.

- Should $60.00 prove reliable support, prices may rebound toward $65,00 and the 50-day SMA.

- Looking at the charts, a decline below $60.00 may send prices toward the $57.00 and $55.00 region.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.