Daily Market Analysis and Forex News

Market round-up: Tariff flip-flop, US CPI slows, Big Bank Earnings

Markets rally as Trump U-turns on reciprocal tariffs

U.S. slaps 125% tariffs on Chinese goods

Gold ↑ nearly 3% week-to-date

US CPI unexpectedly cools in March

US500 waits on big US bank earnings

It has been an extraordinary week defined by confusion over Trump’s tariff agenda.

On Wednesday evening, Trump shocked markets by announcing a 90-day pause on reciprocal tariffs while raising duties on Chinese goods to 125%!

To be clear, tariffs above 10% for all countries excluding China will be paused for 90 days.

This sent US equities surging, with the US500 ending almost 10% higher while the NAS100 rallied 12%. On Thursday, Asian shares surged the most since 2022, while European markets opened higher with the EU50 jumping as much as 8%.

Although Trump’s surprise decision to pause tariffs brought relief to markets, tensions are still sizzling between the worlds two largest economies.

As of now the US has imposed 125% tariffs on Chinese goods, while China has raised tariffs on US goods to 84%. Any fresh signs of escalating tensions may shatter this market optimism, sparking fresh risk aversion.

Gold steady as US CPI cools.

Gold prices edged higher on Thursday after reports revealed that US inflation cooled in March.

Annual inflation increased 2.4%, lower than the 2.6% market forecast while the core figure rose 2.8% less than the 3% forecast.

The precious metal could push higher despite the 90-day pause on reciprocal tariffs. It’s worth keeping in mind that trade uncertainty remains a key theme.

The negative knock-on effect could hit the global economy, forcing central banks to cut rates to stimulate growth. So, bets on lower US rates could propel gold prices higher.

- Looking at the charts, a breakout above $3140 may open a path back toward the all-time high at $3167.84, $3180, and $3200.

- Weakness below $3080 could encourage a decline back toward $3020.”

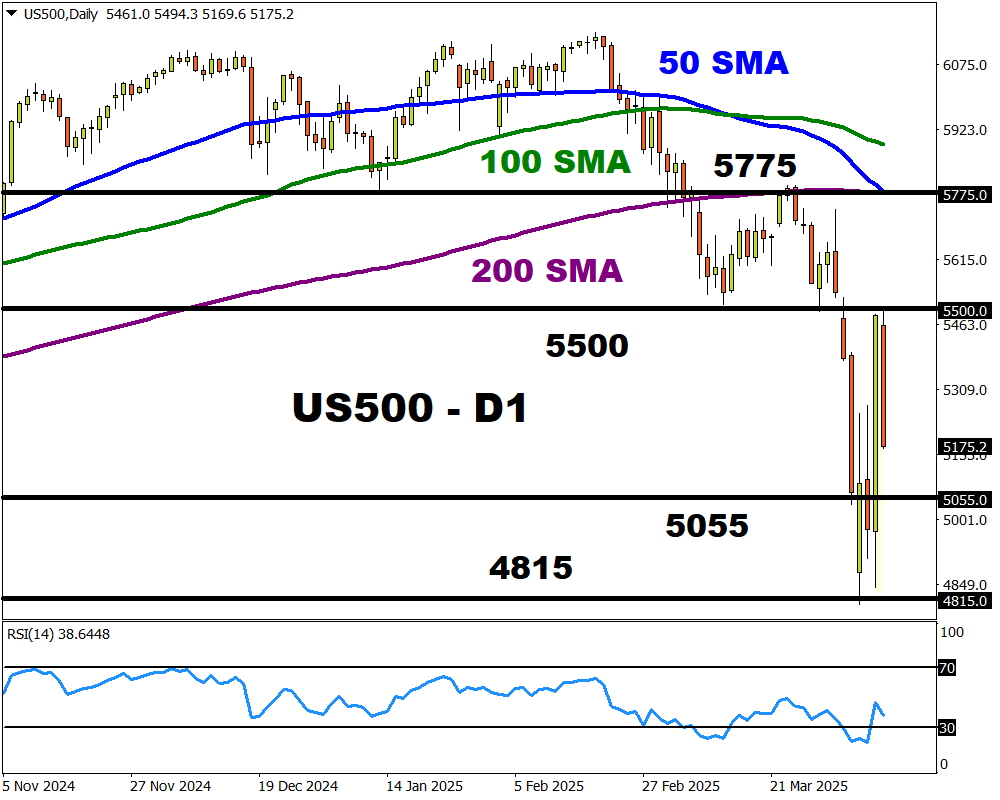

US500 set for fresh volatility?

First quarter earnings season kicks off on Friday, April 11th, led by the biggest US banks. Giants such as JPMorgan, Wells Fargo and BlackRock will be reporting their financial results.

Given how Trump’s tariffs have sparked much uncertainty, this could influence bank earnings and investor sentiment. So, all eyes will be on the future guidance and any insight into what Trump’s tariffs mean for the business outlook.

FXTM’s US500 could see heightened levels of volatility given how financials make up almost 15% of its weighting.

- A set of positive earnings and optimistic future guidance could push the US500 back toward the 200-day SMA at 5775.

- A disappointing set of earnings and negative guidance may drag the US500 back toward 5050 and 4815.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.