Daily Market Analysis and Forex News

Market round-up: Fed reassures, BoE holds, Gold hits records

Fed holds rates but attempt to calm tariff fears

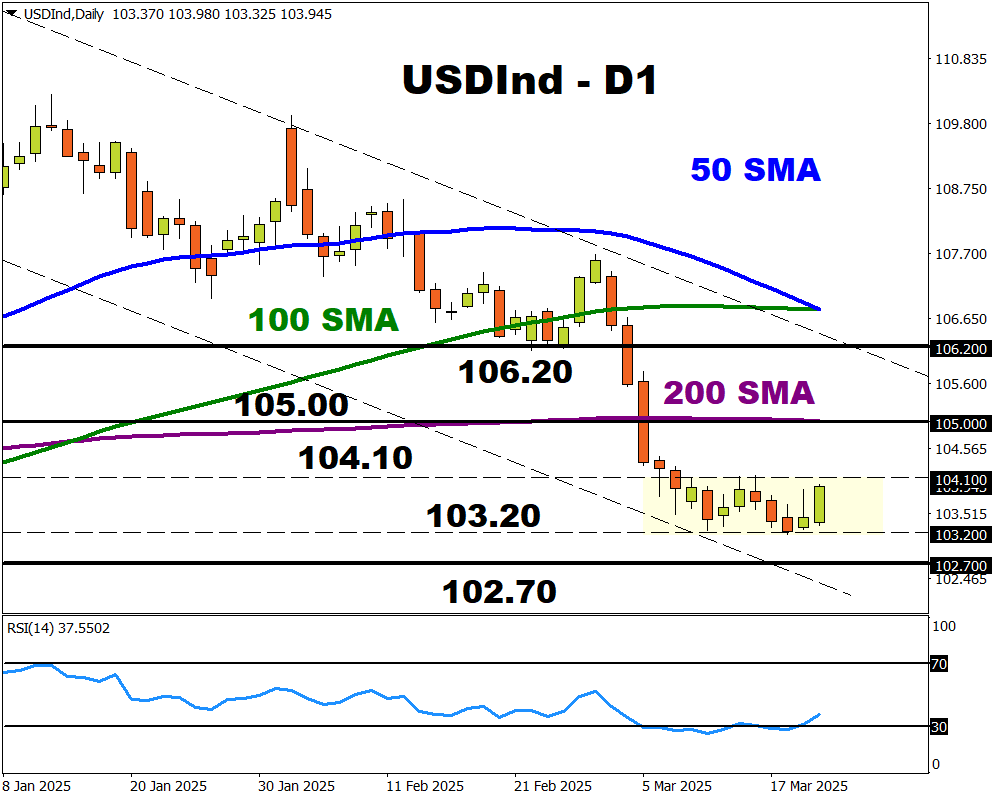

USDInd on breakout watch: support - 103.20, resistance - 104.10

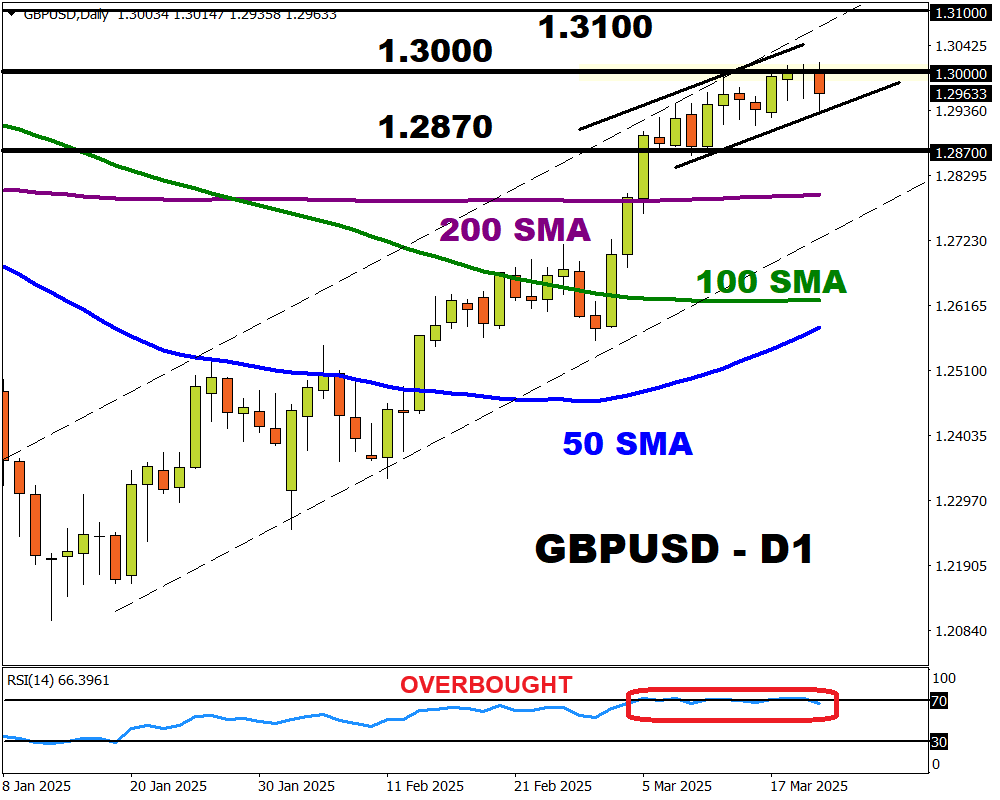

GBPUSD jumps on BoE hawkish tilt, ↑ 3% MTD

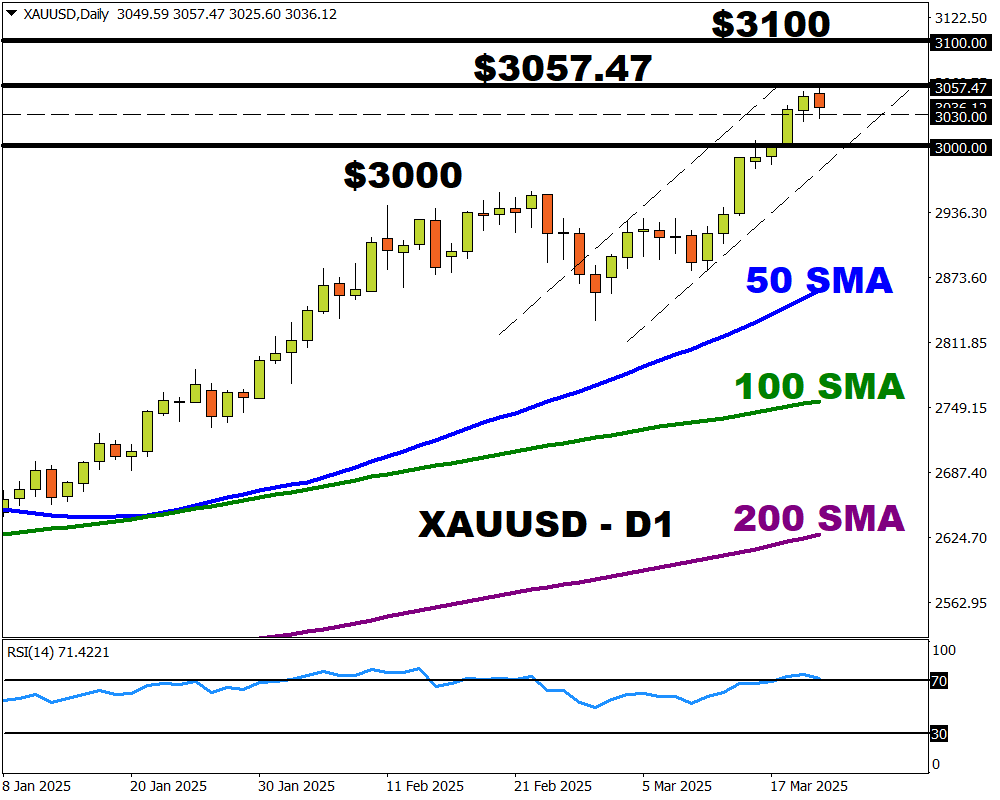

XAUUSD hits fresh records above $3057, ↑ nearly 16% YTD

Relief initially swept through markets after the Fed sought to calm fears around the impacts of Trump’s tariffs.

To be clear, US growth forecasts were slashed and Jerome Powell cited uncertainty over tariffs.

However, he suggested that any increase in inflation caused by tariffs would be “transitory”.

So, while the Fed is in “no hurry to move”, there was breathing room to cut rates down the road. This sentiment was reflected in the updated dot plot that showed officials still see two more rate cuts this year.

Despite the Fed’s attempts, US equity futures are flashing red as investors questioned its ability to cut rates in the face of rising inflation.

Note: There was a slight uptick in the initial jobless claims figures this afternoon, but the dollar offered a muted response.

As of writing, traders are pricing in a 41% probability of 3 more rate cuts in 2025.

Looking at the charts, the USDInd remains within a range with support at 103.20 and resistance at 104.10.

BoE stands pat on rates

GBPUSD clawed back some losses after the Bank of England left interest rates unchanged at 4.5%.

Although this decision was widely expected, only one policymaker backed a rate cut – showing a hawkish tilt. UK jobs data was also released, showing stable employment and wage growth in January. But this was likely overshadowed by the BoE decision.

Traders are now seeing a 65% probability of a BoE rate cut by May, a drop from the 73% odds before the rate decision.

The BoE’s cautious approach toward rate cuts may support the GBPUSD, which has jumped over 3% this month.

Looking at the charts, prices remain in a bullish channel, but the RSI is overbought with key resistance at 1.3000.

- A breakout above 1.3000 may open a path toward 1.3100.

- Sustained weakness below 1.3000 may trigger a selloff toward 1.2870.

Gold headed for $3100?

On Wednesday evening, gold was boosted by a weaker dollar after the Fed cut growth forecasts and Powell cited uncertainty around Trump’s tariffs.

After hitting an all-time high above $3057 on Thursday morning, prices tumbled due to an appreciating dollar and possible profit-taking.

Still, gold is up almost 16% year-to-date and could be headed for its best quarter in almost 10 years.

Looking at the charts, gold remains firmly bullish with the next resistance at the psychological $3100 level.

However, bulls may take a breather in the short term after hitting repeated record highs this week.

- Weakness below $3030 may signal a decline toward $3023, $3015 and $3000.

- Should prices push back above $3050, the all-time high above $3057 may be tested again, followed by $3100.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.