Daily Market Analysis and Forex News

Market round-up: Fed Cut Hopes, Trade Uncertainty, Gold Rebounds

US equities rise on Fed cut bets; NAS100 hits 19200

China rejects Trump’s claims of ongoing tariff talks

Gold rebounds from biggest one-day loss in 2025

Alphabet publishes earnings after US market close on Thursday

US equities flashed green on Thursday as bets jumped around the Fed cutting interest rates sooner than expected to prevent a recession.

FXTM’s US500 ventured toward 5500 while the NAS100 rallied over 2% ahead of Alphabet’s earnings after market close.

These gains were powered by Fed officials hinting at a possible rate cut in the face of soft economic data.

Traders are currently pricing in 3 Fed rate cuts in 2025 with the odd of a 4th cut by December at 45%.

Although Wall Street may edge higher in the near term, uncertainty around global trade developments is likely to limit upside gains.

China rejects claims of active trade talks

In the latest twist and turns to Trump’s trade drama, China has demanded that the US revoke all unilateral tariffs and denied talks on reaching a trade deal. A major contrast from the positive remarks by Trump and Bessent earlier in the week.

Swirling uncertainty around trade developments may set the tone for weeks ahead.

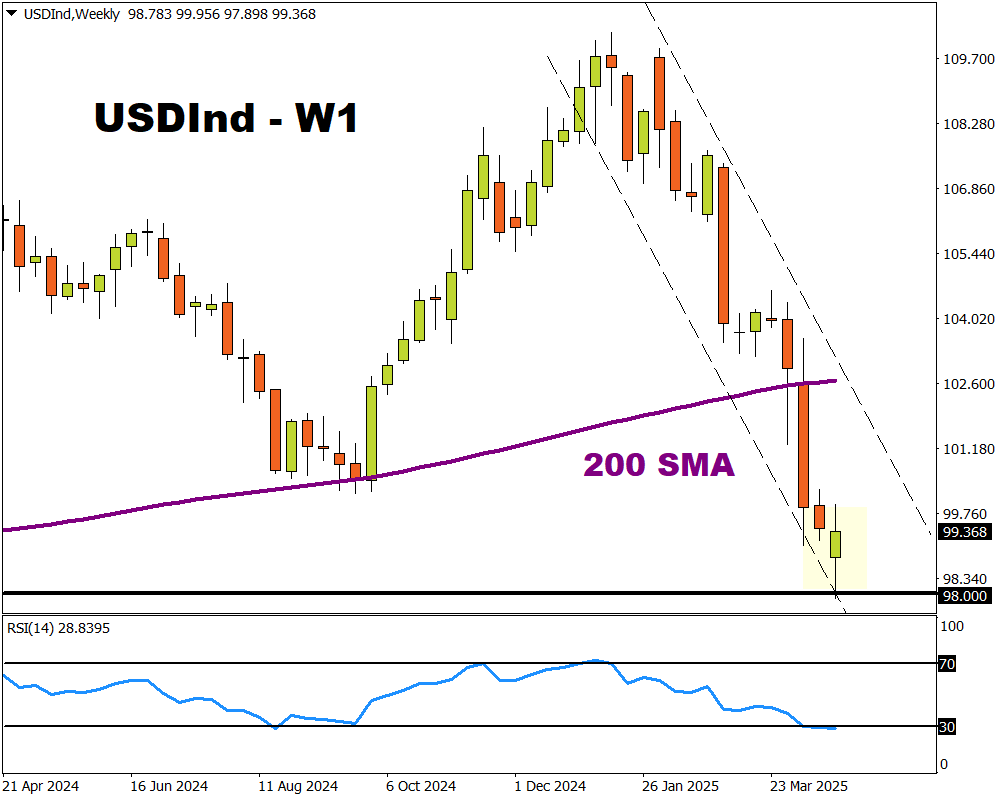

Looking at FX, the Dollar Index may bag its first weekly gain since mid-March.

In terms of best FX performer this week vs the USD, the crown goes to the New Zealand Dollar.

Much of the NZD gains were based on the initial optimism around US-China trade talks. However, this fresh uncertainty could result in losses in the week ahead.

Note: The NZD is seen as a China-proxy as China is a major trading partner in New Zealand.

Gold rebounds on renewed uncertainty

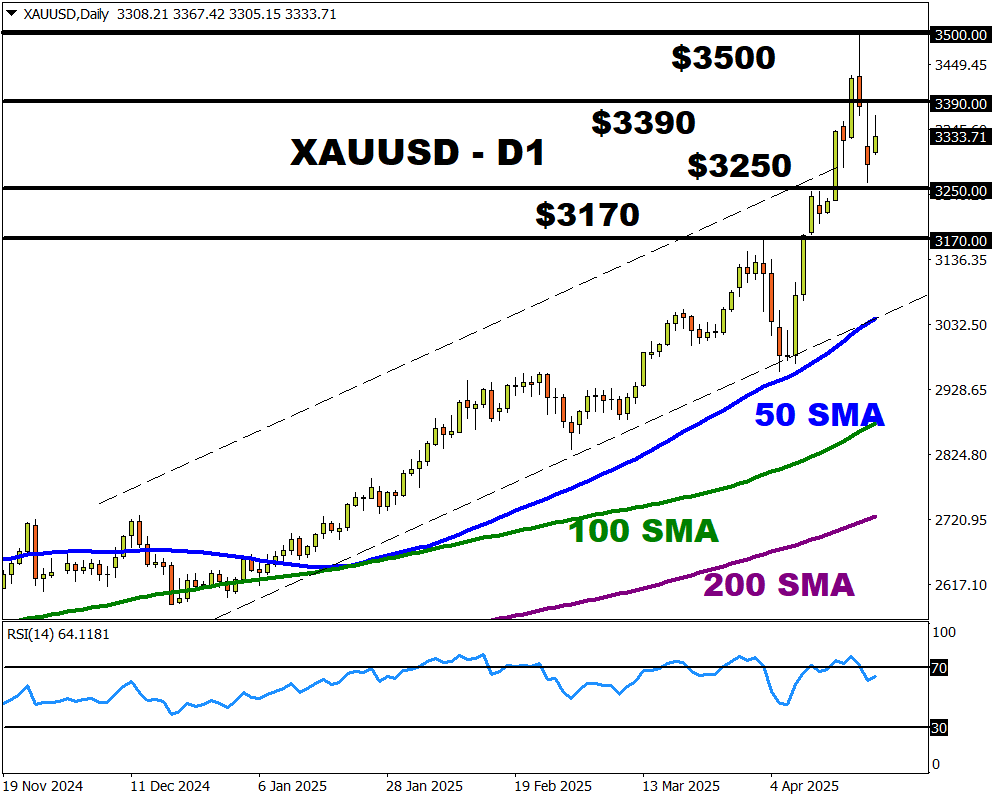

In the commodity arena, gold rebounded from its biggest one-day loss this year thanks to a return of trade uncertainty and rising Fed cut bets.

The precious metal is up 27% year-to-date, with fundamentals favouring higher prices. However, a technical correction could be on the horizon if bears breach $3250.

On the flip side, a breakout back above $3400 may open a path toward $3500 and fresh all-time highs.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.