Daily Market Analysis and Forex News

Central Bank Preview: GBPCHF braces for BoE/SNB combo

BoE seen holding rates, 70% chance SNB cuts

Over past year SNB triggered moves of ↑ 0.7% & ↓ 0.2%

Over past year BoE triggered moves of ↑ 0.4% & ↓ 0.6%

Bloomberg FX model: GBPCHF has 75% of trading within 1.1252 – 1.1534 over 1-week period

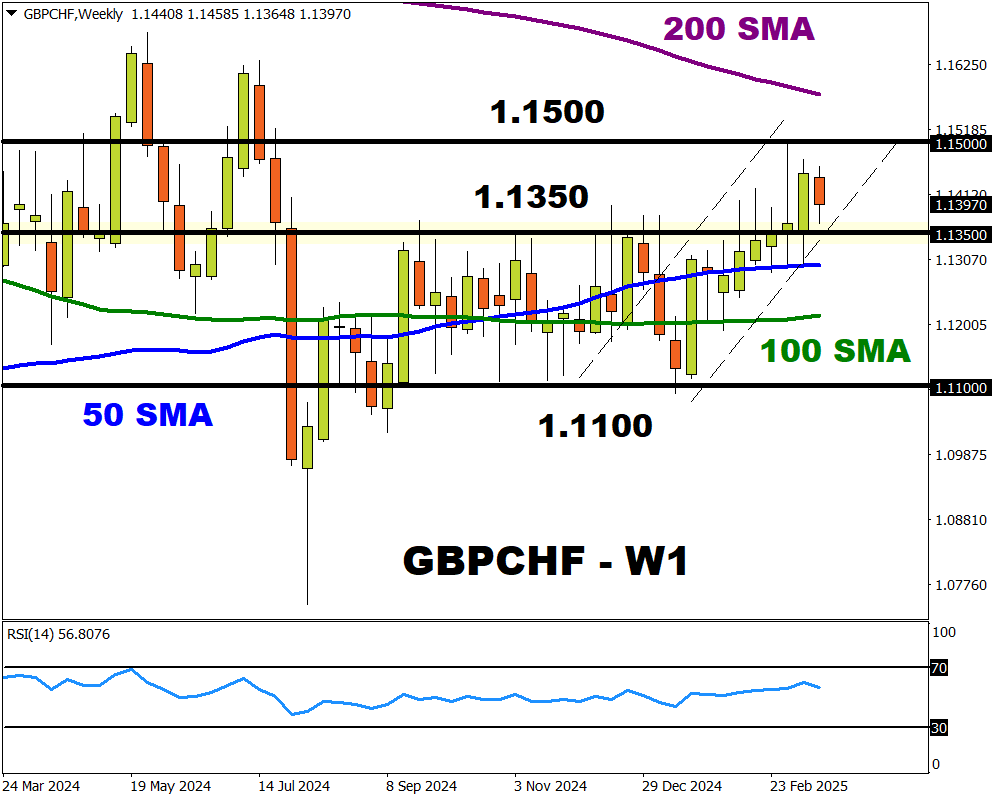

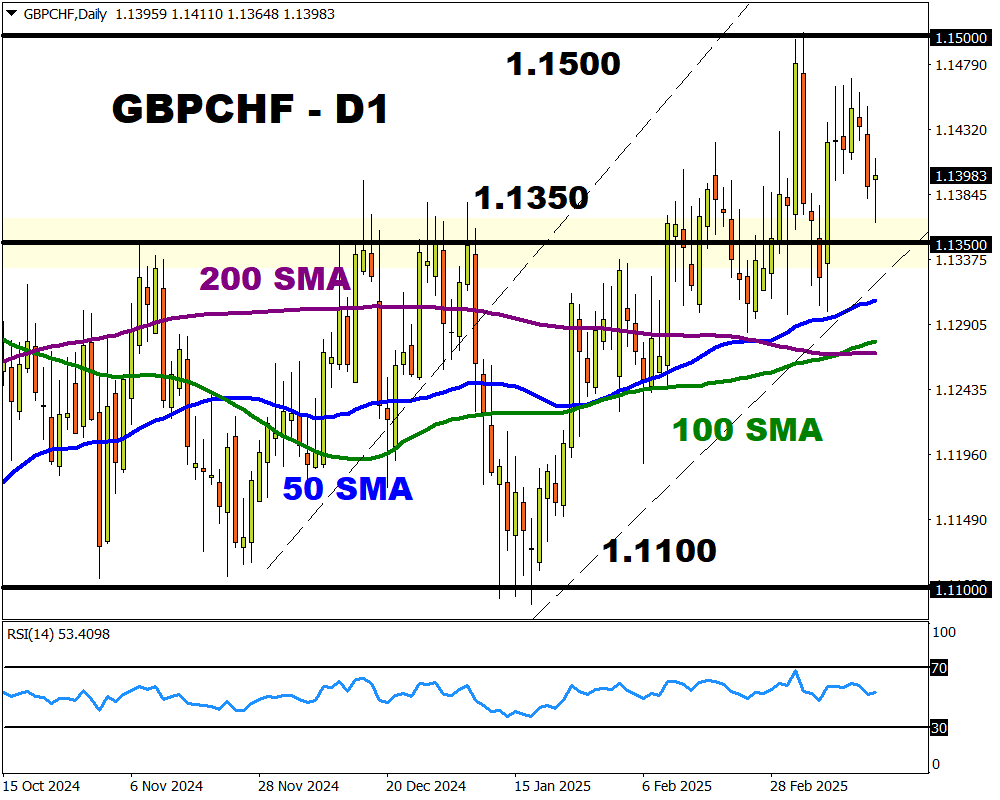

Technical levels: 1.1350, 50 & 200-day SMA

A central bank combo featuring the Swiss National Bank (SNB) and Bank of England (BoE) could rock the GBPCHF on Thursday, 20th March.

The minor currency pair recently broke above resistance at 1.1350 on the weekly charts, though another potential barrier can be seen at 1.1500.

Prices could be gearing up for a potential move up or down.

Here are 3 reasons why:

1 - SNB rate decision

Traders are pricing in a 70% probability that the SNB will cut interest rates in March.

However, this could be a tough decision for the central bank given the conflicting forces.

Low inflation at home and uncertainty over global trade support the argument around lower rates. However, resilient economic growth and currency stability support the case for rates to be left unchanged.

Over the past 12 months, the SNB rate decision has triggered upside moves of as much as 0.7% or declines of 0.2% in a 6-hour window post-release.

Possible scenarios:

- The GBPCHF could jump if the SNB cuts interest rates and signals further cuts in 2025.

- Should the SNB cut rates and signal no more in 2025, GBPCHF may edge lower.

- GBPCHF could tumble if the SNB leaves rates unchanged and strikes a cautious note on future moves.

2 - BoE rate decision

Markets expect the BoE to leave interest rates unchanged, but all eyes will be on the vote among MPC members.

Back in February, all 9 members of the MPC voted to cut rates but 2 voted for a larger cut of 50 basis points. If more members join the dovish camp, this could weaken the pound as BoE cut bets jump.

On the interest rates front, traders are pricing in a 73% probability of a BoE rate cut by May.

Any major changes to these bets may influence the pound’s outlook.

Over the past 12 months, the BoE rate decision has triggered upside moves of as much as 0.4% or declines of 0.6% in a 6-hour window post-release.

Possible scenarios:

- The GBPCHF may rise if the BoE strikes a cautious note on future rate cuts.

- If more MPC members join the dovish camp, this could boost rate cut bets – dragging the GBPCHF lower.

3- Technical forces

The GBPCHF is respecting a bullish channel on the daily timeframe. Prices are trading above the 50, 100 and 200-day SMA.

- Should 1.1350 prove to be reliable support, this may push prices toward 1.1500

- A decline below 1.1350 could drag prices toward the 50, 100 and 200-day SMA at 1.1270.

Bloomberg’s FX model forecasts a 73% chance that USDJPY will trade within the 1.1252 – 1.1534 range, using current levels as a base, over the next one-week period.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.