Week Ahead: Triple focus - Brent, EURUSD and US500 in the spotlight

- Sunday, September 7th: OPEC+ meeting may rock oil benchmarks

- Thursday, September 11th: ECB expected to leave rates unchanged

- EURUSD has 73.5% chance of trading within 1.1513 – 1.1834 over 1-week period

- US CPI forecasted to move US500 ↑ 1% & ↓ 1.5%

- US500: Technica levels – 6550, 6450 and the 50-day SMA.

As we countdown to the crucial US jobs report this afternoon (Friday 5th September), markets are gearing up for another eventful week ahead.

The OPEC+ meeting, key US CPI report, and ECB rate decision, among other heavy-hitting events, could present fresh trading opportunities:

Sunday 7th September

- OIL: OPEC+ meeting on production levels

Monday, 8th September

- CN50: China trade

- JPY: Japan GDP

- GER40: Germany industrial production

- FRA40: French Prime Minister faces a confidence vote

Tuesday, 9th September

- AUD: Australia Westpac consumer confidence

- FRA40: France industrial production

- GBP: UK Chancellor Rachel Reeves speech

- ZAR: South Africa GDP

- TWN: Taiwan trade

Wednesday, 10th September

- CN50: China PPI, CPI

- US500: PPI

Thursday, 11th September

- JPY: Japan PPI

- EUR: ECB rate decision

- US500: US CPI, initial jobless claims, federal budget balance

- OIL: OPEC monthly oil market report

Friday, 12th September

- GER40: Germany CPI

- JP225: Japan industrial production

- NZD: New Zealand BusinessNZ manufacturing PMI

- UK100: UK industrial production

- US500: US University of Michigan consumer sentiment

Here are 3 assets that could see heightened volatility:

1) BRENT: OPEC+ Meeting

On Sunday, 7th September, OPEC+ will meet to discuss October production levels.

At their last meeting in August, the cartel raised production by 547,000 bpd for September – completing the addition of 2.5 million barrels a day.

But there have been reports that OPEC+ may consider a fresh round of production increases at a time when producers outside the alliance have also ramped up supplies. On top of this, concerns remain elevated over weakening crude demand in the face of Trump’s tariffs.

- Oil benchmarks have shed over 10% year-to-date and may fall further if OPEC+ moves ahead with further increases in oil production. Bearish price targets for Brent are $65 and $62.50.

- Should OPEC+ pause production increases for October, this could support oil as oversupply fears cool. Bullish price targets for Brent are the 50-day SMA, $69 and the 200-day SMA.

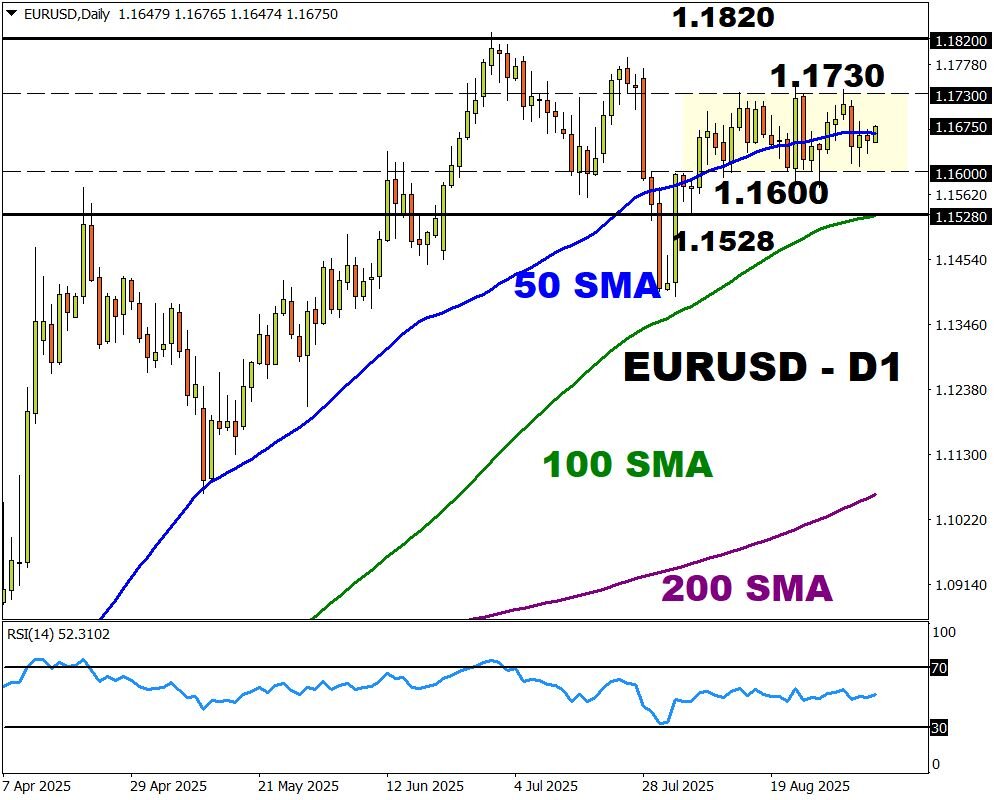

2) EURUSD: ECB meeting

The world’s most-traded FX pair has been trapped within a range since early August.

A potential breakout may be triggered by the incoming NFP this Friday or European Central Bank (ECB) decision on Thursday 11th September.

Markets widely expect the ECB to leave rates unchanged but any clues on future policy moves may trigger volatility.

Traders are pricing in a 32% probability that the ECB cuts rates by December 2025.

Although inflation in the Eurozone has stabilized around the 2% target, growth remains sluggish while France faces political instability.

EURUSD is forecast to move 0.4% up or 0.2% down in a 6-hour window after the ECB meeting.

Technical outlook

The EURUSD is trading withing a 130-pip range with support at 1.1600 and resistance at 1.1730.

- A breakout above the 1.1730 resistance may trigger a move toward 1.1820.

- Weakness below 1.1600 may spark a selloff toward the 100-day SMA at 1.1525.

Bloomberg forecast model: 73.5% chance EURUSD trades between 1.1517 – 1.1838 over the next one-week period.

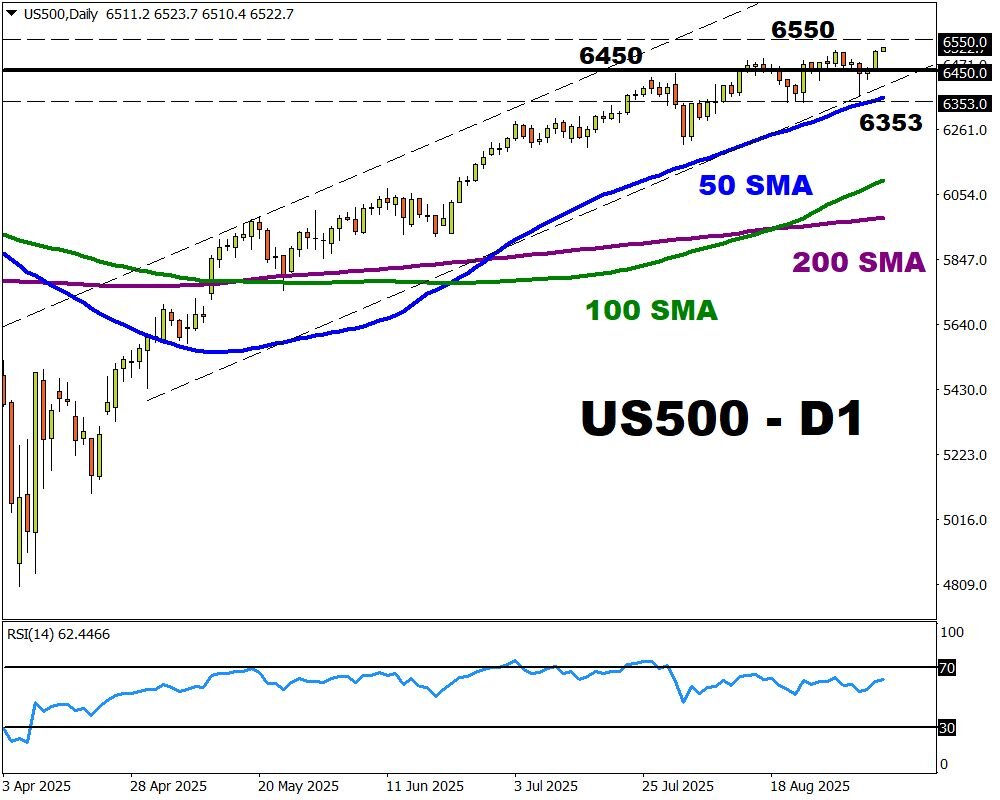

3) US500: US August CPI report

FXTM’s US500 may be rattled by the latest US inflation report on Thursday 11th September.

The index has gained over 10% year-to-date with price trading around 6500 as of writing.

Markets are forecasting:

- CPI year-on-year August 2025 vs. August 2024) to rise 2.9% from 2.7%.

- Core CPI year-on-year to remain unchanged at 3.1%.

- CPI month-on-month (August 2025 vs July 2025) to rise 0.3% from 0.2%.

- Core CPI month-on-month to remain unchanged at 0.3%.

Signs of rising inflationary pressure may cool bets around the Fed cutting interest rates, pressuring the US500 as a result.

Note: Other key data including the PPI, Initial jobless claims, and Michigan Consumer Sentiment may also impact the US500.

US500 is forecast to move 1% up or 1.5% down in a 6-hour window after the US CPI report.

- Key technical levels can be found at 6550, 6450 and the 50-day SMA.

Note: This chart was published before the US NFP report on Friday.