Market round-up: Steady US Inflation, ECB holds rates, US500 hits ATH

- Tame US CPI reinforces Fed cut bets

- USD weakens against every single G10 currency

- ECB leaves rates unchanged as expected

- US500 hits fresh all-time high beyond 6590

- Gold bullish but a correction could be pending

It has been a week filled with political risk, geopolitical uncertainty and key macro events.

Despite the caution, equities have gained thanks to bets around lower US interest rates.

On Thursday, the relatively tame US inflation report reinforced these expectations as traders prepared for the Fed to cut rates for the first time in 2025.

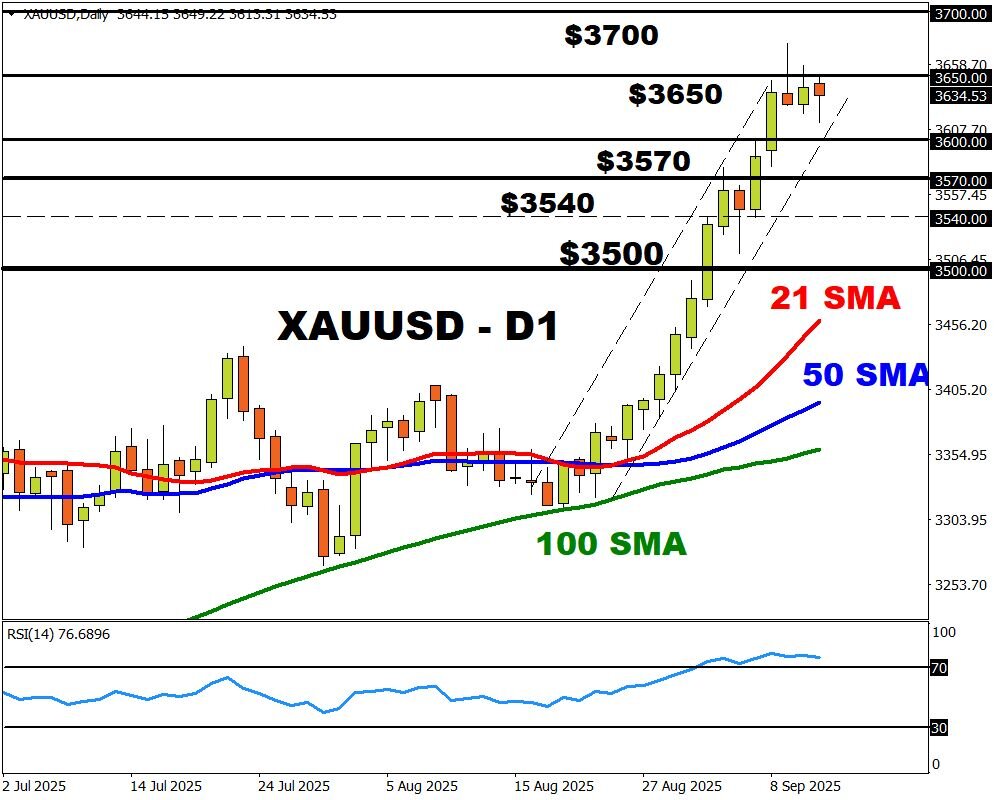

Annual inflation printed in line with forecasts by rising 2.9% while the core also rose 3.1% matching market expectations. In response, the US500 rallied to a fresh all-time high while the dollar tumbled across the board. Gold initially jumped before facing resistance at $3640.

Traders have fully priced in a Fed cut in September and October, with the odds of a third rate cut by December at 95%.

This has weakened FXTM’s USDInd with prices approaching support at 97.15.

In Europe, the European Central Bank (ECB) kept interest rates unchanged, citing cooling inflationary pressures and stabilizing economic conditions. This stance prompted traders to slash bets around the ECB cutting rates in 2025 with the odds of a move by December falling to 25%.

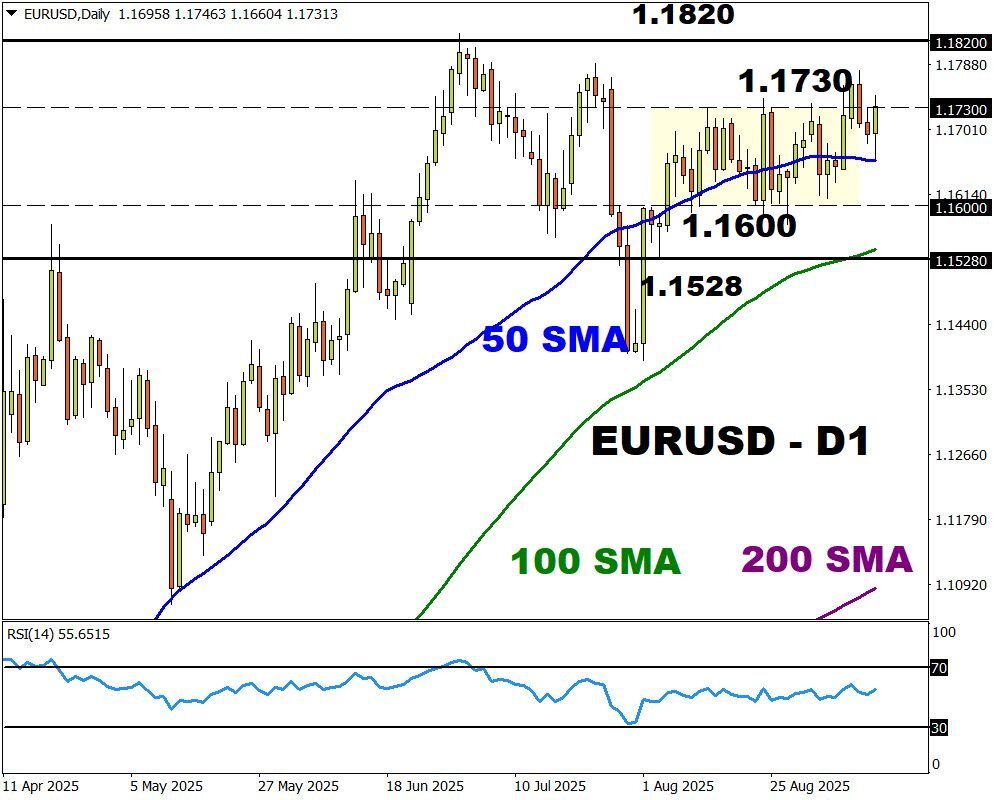

The EURUSD offered a mixed response to the decision with prices still within the 130-pip range.

In the commodity space, gold is up over 5% this month – taking 2025 gains to almost 40%. The precious metal remains firmly bullish thanks to both technical and fundamental forces.

Should bulls push back above $3640, prices may retest $3675 and $3700. However, weakness below $3640 could send prices toward $3600, $3540 and $3500.