Introducing ETF CFDs

FXTM gives you more. And today, that means more assets to trade!

ETF CFDs are now available to trade on FXTM. But what are they, and what makes them such an exciting opportunity for traders?

Whether you’re new to Exchange Traded Funds, or a seasoned trader looking to diversify, this blog will help you understand the value of ETF CFDs and how they can enhance your trading experience.

What are ETFs?

Let's start with a quick definition.

Exchange-Traded Funds (or ETFs) are a collection of related assets—like stocks, bonds, or commodities—that trade on an exchange as one, similar to an individual stock.

You can think of an ETF like a basket of fruit. Instead of buying individual fruits—like apples, oranges, or bananas—you buy the whole basket, which contains a mix of all the fruits.

This makes it easier to diversify your investments without having to pick and manage each asset separately. Just like the fruit basket offers variety in one package, an ETF offers exposure to multiple assets in a single trade.

There are a wide variety of ETFs available, each with a different goal, from tracking a particular index or industry, to focusing on a specific country or asset class.

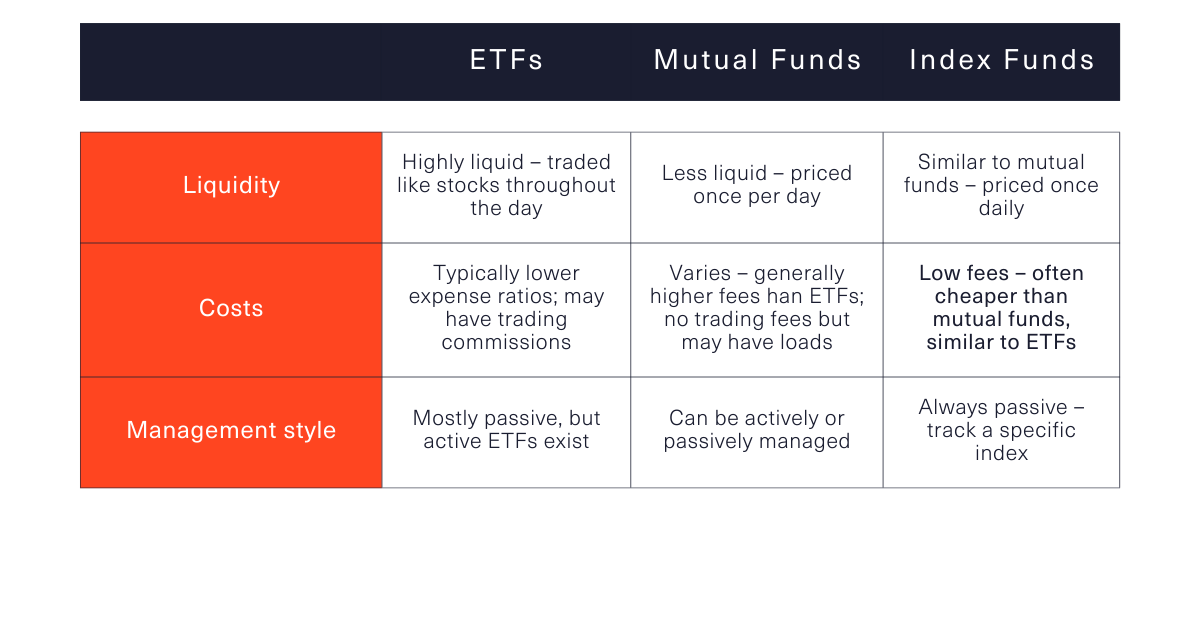

What's the difference between ETFs and mutual or index funds?

Like a mutual or index fund, many ETFs also aim to track a particular market sector or industry. However, there are a few key differences in how they are structured, and how they are traded.

ETFs vs mutual funds

- ETFs trade on an exchange like stocks, while mutual funds have a set price at the end of each trading day. This means ETFs can be bought and sold throughout the day while funds are only traded once daily

- ETFs tend to have lower fees than mutual funds

- ETFs are 'passively' managed, meaning they are trying to track a specific market. Mutual funds however are 'actively' managed, attempting to 'beat the market'

ETFs vs index funds

- ETFs can be traded throughout the day on an exchange, while index funds are purchased at the end of the trading day at the net asset value (NAV)

- ETFs usually have lower expense ratios compared to index funds, though both typically offer cost-effective investment options

- ETFs are structured to track a specific market passively, while index funds are also passively managed but are not traded like stocks during the day

Overall, ETFs are a popular choice for traders looking for low-cost, diversified investments.

What are ETF CFDs?

Ok, so that's ETFs. What about ETF CFDs? What on earth do all those letters mean!

Let's it keep it simple. Essentially, an ETF CFD is a different way to trade ETFs.

ETF CFDs allow you to speculate on the price movements of ETFs without actually owning the underlying assets.

When trading ETF CFDs, you’re not buying the underlying ETF itself. Instead, you’re trading a Contract for Difference, entering into an agreement to exchange the price difference of the ETF between the time you open and close the trade.

This approach offers a number of unique advantages.

Why trade ETF CFDs?

There are many compelling reasons to add ETF CFDs to your trading toolkit.

1. Diversification

ETF CFDs allow you to spread risk by offering exposure to multiple sectors, industries, or markets through a single trade.

For example, the iShares Russell 2000 ETF CFD gives traders access to small-cap stocks across various sectors in the US. A lot of diversifications in one package.

2. Access to market trends and themes

ETF CFDs are ideal for thematic investing.

Want exposure to innovation and emerging technologies? Try the ARK Innovation ETF CFD, which focuses on disruptive companies. Interested in commodities or precious metals?

The SPDR Gold Shares CFD lets you trade gold price movements.

3. Liquidity

ETF CFDs trade on exchanges the same way individual stocks do, allowing you to buy or sell at any point during market hours.

This flexibility removes the end-of-day trading limitation associated with mutual funds.

4. Leverage

ETF CFDs provide the ability to use leverage, allowing you to control a larger position with a smaller amount of capital.

While leverage can amplify potential returns, it is important to remember that it also increases the potential risk. Proper risk management is essential when utilising leverage to ensure it aligns with your overall trading strategy and risk tolerance.

5. Hedging

If you hold a long-term ETF position and anticipate a short-term market dip, ETF CFDs can act as a hedge to protect your portfolio.

Use CFD trades for temporary downside protection without disturbing your long-term investment strategy.

6. Short selling opportunities

ETF CFDs offer the advantage of short selling, enabling traders to profit from declining markets.

This flexibility allows you to capitalise on bearish trends or hedge existing positions during periods of market downturns.

However, short selling carries its own risks, so deploying it as part of a well-considered strategy is crucial to achieving your trading goals.

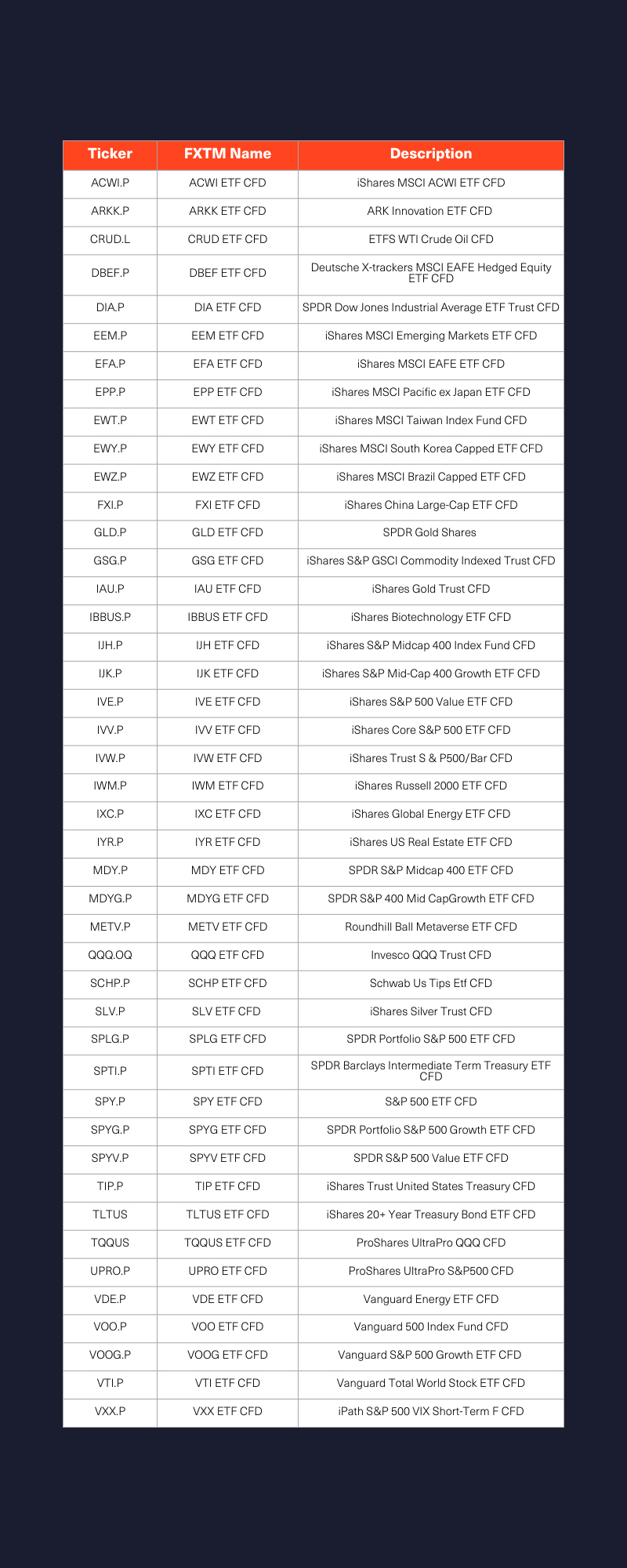

Which ETF CFDs can I trade with FXTM?

FXTM currently offers a wide selection of 44 ETF CFDs - spanning various themes and markets, ensuring something for every investment strategy. Here are some highlights:

- Vanguard S&P 500 Growth ETF CFD (VOOG.P) – Focus on top companies driving US market growth.

- iShares MSCI Emerging Markets ETF CFD (EEM.P) – Gain exposure to fast-growing economies globally.

- SPDR Gold Shares CFD (GLD.P) – Trade on the movements of gold prices without needing to hold the physical asset.

- ARK Innovation ETF CFD (ARKK.P) – Invest in trending disruptive companies.

For a complete list of available ETF CFDs, check out the table below:

Trading strategies for ETF CFDs

Once you’re ready to start, it’s useful to have some well-tested strategies in your trading arsenal.

1. Trend following

This strategy involves tracking price trends and joining them at opportune times.

For example, ETFs tracking a sector experiencing strong growth, like renewable energy, could provide lucrative opportunities. Use tools like Moving Averages (MAs) to identify trends.

2. Breakout trading

Watch for price levels where an ETF CFD breaks past significant support or resistance. This can indicate strong momentum, which traders can exploit by entering positions aligned to the breakout direction.

Tools like Fibonacci retracements help spot breakouts effectively.

3. Hedging with sector ETFs

Feel like the tech industry is overheating? Use a CFD on tech-focused ETFs, like the NASDAQ 100 ETF CFD (QQQ.OQ), to hedge positions during times of expected downturns while maintaining overall market exposure.

ETF CFD risks and considerations

While ETF CFDs offer flexibility and versatility, they come with risks that should not be overlooked.

1. Leverage risks

The use of leverage amplifies both potential gains and potential losses. Misjudging trades under high leverage could result in significant losses. Always manage your risk carefully using stop-loss tools.

2. Liquidity and volatility

Some less-traded ETFs may experience low liquidity, which can lead to slippage. Additionally, market volatility can result in sudden price swings, underscoring the importance of maintaining robust risk management.

3. Costs

While avoiding ETF management fees, CFD positions can carry overnight financing fees, particularly for leveraged positions. Keep track of these additional costs to avoid eroding your profits.

The bottom line

ETF CFDs are an incredible tool to add diversity, flexibility, and depth to your trading strategy. Whether you’re interested in emerging markets, disruptive technologies, or classic safe havens like gold, there’s an ETF CFD for you.

Start trading ETF CFDs today with FXTM and take advantage of cutting-edge insights, tools, and exceptional customer support. Open your free FXTM account now.

ابدأ التداول مع FXTM

فتح حساباختر حسابك

ابدأ التداول مع وسيط رائد يقدم لك المزيد.