Daily Market Analysis and Forex News

Week Ahead: GBPUSD “golden cross” sets stage for bullish breakout

GBPUSD ↑ almost 3% MTD, trading near 2025 high

“Golden cross” chart pattern signals potential bullish move

UK data + Bailey speech + US data = heightened volatility?

UK retail sales sparked moves of ↑ 0.3% & ↓ 0.4% over past year

Technical levels – 1.3400, 1.3300 & 1.3150

Stability may return to markets as investors adopt a wait-and-see approach toward tariff talks.

There is cautious optimism over the US striking a trade deal with Japan and Europe, while China has expressed interest in talks if Trump shows respect.

Easing trade tensions could lift sentiment in the week ahead, providing fresh opportunities across financial markets.

Beyond trade developments, key economic data and corporate earnings will be in focus:

Monday, 21st April

- CN50: China loan prime rates

Tuesday, 22nd April

- AU200: S&P Global Australia PMI’s

- NAS100: Tesla earnings

Wednesday, 23rd April

- EU50: Euro-Area Flash PMI’s

- GER40: HCOB Germany PMI’s

- GBP: S&P Global UK PMI’s, BoE Governor Bailey speech

- US500: S&P Global US PMI’s, Fed Beige Book

- US30: Boeing earnings

Thursday, 24th April

- GER40: Germany IFO Business Climate

- GBP: GfK Consumer Confidence

- NAS100: Initial jobless claims, Alphabet, Intel earnings

Friday, 25th April

- JP225: Tokyo CPI

- GBP: UK Retail Sales

- RUS2000: University of Michigan Sentiment

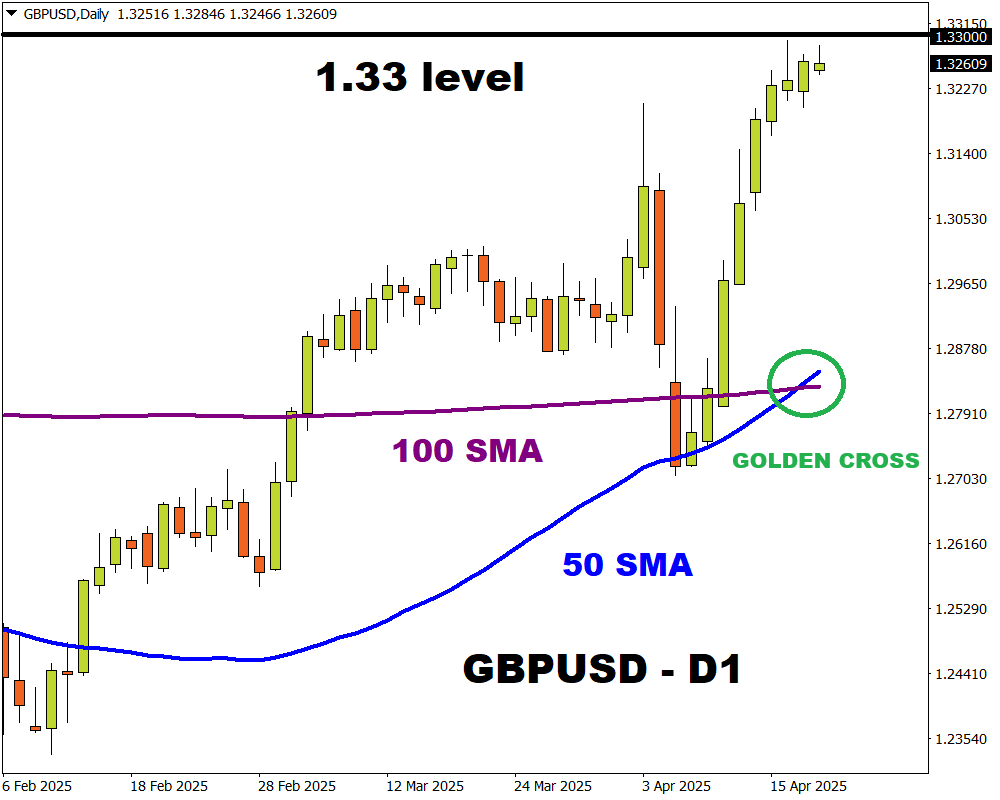

Our attention falls on the GBPUSD which has formed a “golden cross” pattern on the daily charts.

Note: A golden cross is when an asset’s 50-day simple moving average (SMA) crosses above its 200-day SMA. This event indicates that prices may push higher.

Over the past two weeks, the GBPUSD has been on a tear thanks to a broadly weaker dollar. Prices have jumped almost 3% this month, pushing year-to-date gains to 6%.

With the major currency pair approaching resistance at 1.3300, a significant breakout could be on the horizon.

Here are 3 reasons why:

1) UK data + BoE Bailey speech

The incoming UK data could provide insight into how the economy fared during mounting uncertainty over US tariff announcements.

On Wednesday, the latest S&P Global UK PMIs will be published, followed by the GfK consumer Confidence on Thursday and UK retail sales on Friday. Much attention will be paid to BoE Governor Bailey’s speech mid-week which may offer clues on future policy moves.

Note: Over the past 12 months, the UK retail sales report has sparked upside moves of as much as 0.3% or declines of 0.4% in the 6 hours post-release.

- The GBPUSD could appreciate if overall data prints better than expected and Bailey strikes a hawkish note.

- If UK economic data disappoints and Bailey expresses concern over the UK economic outlook, the GBPUSD may sink as BoE cut bets jump.

As of writing traders are currently pricing in 3 BoE cuts in 2025 with the probability of a fourth one by December at 23%.

2) US data + Fed Beige Book

Upcoming US data and the Fed’s Beige Book may illustrate how the world’s largest economy has been impacted by trade uncertainty.

Mid-week, the latest US S&P PMIs and beige book will be published, followed by the initial jobless claims on Thursday and the University of Michigan Sentiment on Friday.

Note: Over the past 12 months, the US S&P PMI reports have triggered upside moves of as much as 0.5% or declines of 0.6% in a 6-hour window post-release.

- A solid set of economic reports from the United States may boost the dollar, dragging the GBPUSD lower.

- Should the dollar weaken on soft economic data, the GBPUSD may push higher.

3) Technical forces

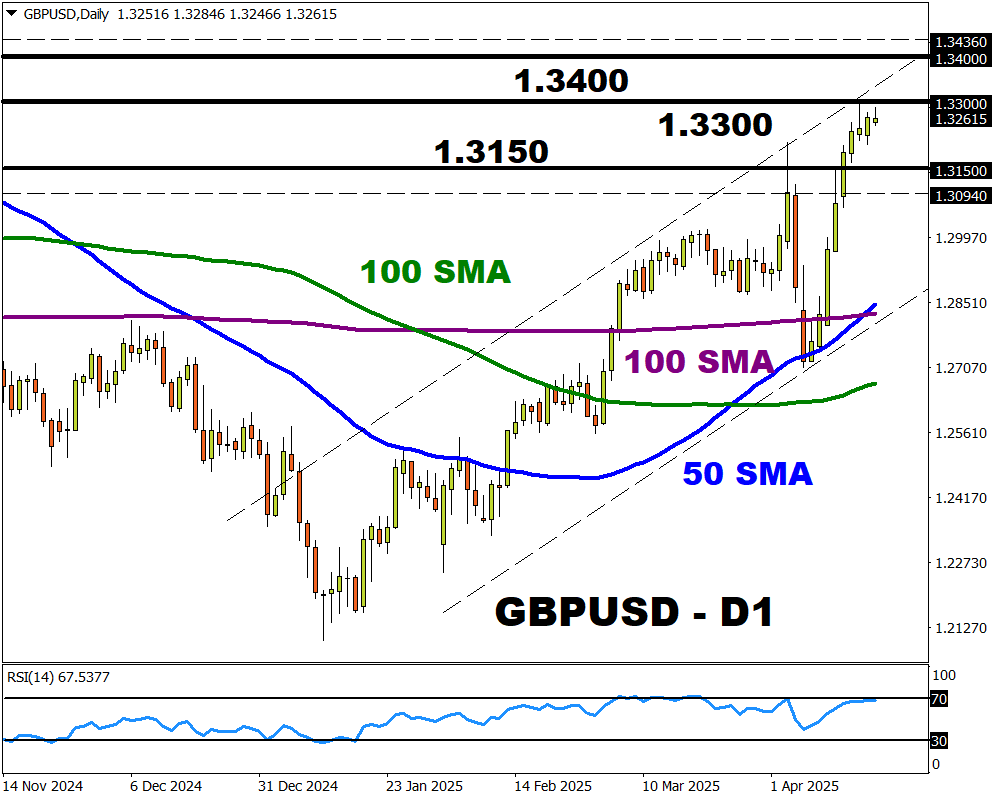

The GBPUSD is firmly bullish on the daily charts with prices trading above the 50, 100 and 200-day SMA. As discussed earlier, the “golden cross” pattern is a strong bullish signal with key resistance at 1.3300.

- A daily close above 1.3300 may trigger an incline toward 1.3400 and 1.3436 – the upper limit of Bloomberg’s FX model.

- Sustained weakness below 1.3300, may see prices decline toward 1.3150 and 1.3094 – the lower bound of Bloomberg’s FX model.

Bloomberg’s FX model forecasts a 76% chance that GBPUSD will trade within the 1.3094 – 1.3436 range, using current levels as a base, over the next one-week period.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.